While the U.S. cycling industry’s unprecedented growth in the earlier months of the COVID-19 pandemic was primarily driven by sales of family-friendly, adult lifestyle and children’s bicycles, the storyline evolved in June. The 63% year-over year growth for bike sales in June primarily stemmed from higher-end bikes which are typically purchased by enthusiasts, including road, gravel, and full suspension mountain bikes, as well as electric bikes, show the latest figures from The NPD Group. The shift was at least partly driven by the shortages at retail of those “family-friendly, adult lifestyle and children’s bicycles.”

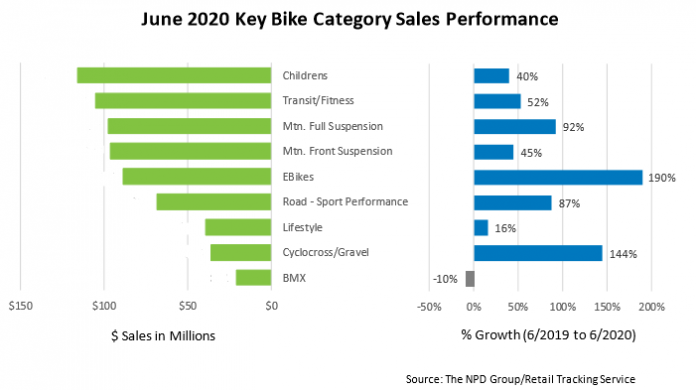

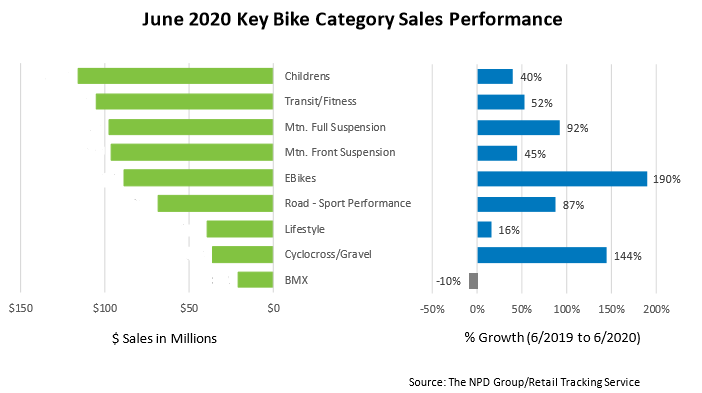

Even so, sales of bikes with average selling prices above $1,000 experienced impressive growth in June 2020 compared to the same month last year, said NPD Group. Full suspension mountain bikes were up 92% in dollars, gravel bikes +144%, sport performance road bikes +87%, and e-bikes +190%.

The growth in children’s, lifestyle and transit/fitness bikes slowed compared to their April and May 2020 rates, likely as a result of lowered inventories at retail. Although June growth for these categories was lower than that of the performance categories, they showed significant average sales price increases. June average selling prices were up 20% compared to the same period last year for lifestyle bikes, +33% for transit/fitness, and +13% children’s bikes.

“The growth of these performance-based segments is likely a result of a few factors. Consumers of these more expensive bikes may have delayed purchases in the early months of the crisis, creating pent-up demand for these categories. Additionally, with a continuation of working from home for many, and as gyms and health clubs are unable to reopen in many states, consumers may be more willing to invest in higher-priced, performance-oriented bikes as a fitness option for the long haul,” said Dirk Sorenson, sports industry analyst, The NPD Group.