Retail Tech Reboot – A Near-Term Perspective on In-Store IT

by: Martin Vilaboy

The race is on to digitize the brick-and-mortar store, and there is no turning back. Anxious to stem customer defections to Amazon and remain relevant amid record ecommerce growth and declining foot traffic, major physical retailers are placing huge bets on super-high-tech wizardry they hope will engage shoppers enough to keep them coming through the doors.

One only need look to Walmart, which recently launched a tech incubator to invest in augmented reality, machine learning, robotics and other emerging technologies, while rival Target is buying and embedding tech startups into its Target+Techstars accelerator program. Leading grocer Kroger Co., meanwhile, for some time has been testing so-called smart shelves that can track inventory, automate pricing and alert shoppers to item location. Other slick examples include virtual reality goggles at IKEA and Lowe’s that let shoppers preview furniture in their homes or virtually design spaces, Nordstrom’s use of chatbots to suggest holiday gift ideas, and interactive walls and mirrors at clothing dealer Rebecca Minkoff that are designed to ease and enhance the shopping experience.

In between today’s reality, however, and a time when robots know our purchase intent before we do and Amazon’s checkout-free stores dot the landscape, smaller and less-funded shopkeepers considering tech investments should heed some sage advice from Stefan Wentz, chief product and strategy officer at commerce technology provider Radial. “Before I do augmented reality or smart mirrors,” Wentz recently told eMarketer, “how do I make sure that I still have customers to serve in five years?”

In other words, how can physical retailers use in-store technology in the near term to keep customers engaged, or even amazed, and ride the wave of online disruption? Contrary to common assumptions, the goal is not to simply replicate the “online experience” in the store. While omni-channel customer management ultimately is the end game, several studies show that shoppers visit stores because they enjoy and appreciate precisely what is unique about the in-store experience – namely, the tactile experience, the immediacy and, for some, the ability to interact face-to-face with helpful humans. So it stands to reason that in-store technology strategies should look to complement or enhance those inherent characteristics. At the same time, e-commerce undeniably has changed customer behavior, so any in-store reboot also must take into account the expectations created by online shopping.

Beyond a whiz-bang appeal, business technology generally is developed and deployed to address pain points. Have work teams spread around the country? Deploy cloud-based collaboration software. Manual inventory takes too long? Develop scanners and databases to reduce time and cost. Crime rising in the neighborhood? Install a security camera. Pain points are why we build machines and automate processes.

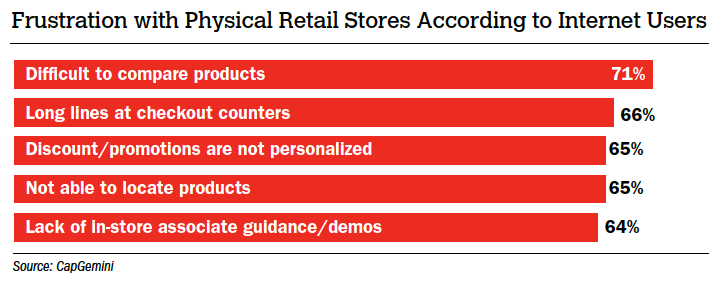

One way retailers can apply this type of thinking to in-store IT investment is to consider the pain points online shoppers have when visiting a physical store. Capgemini did just that in a global survey of Internet users, and while there isn’t really one overriding frustration that aggravated above all else, a handful of complaints do stand out. At the top of the list we see a prime example of how online shopping has changed shopper expectations. Seven out of 10 Internet users said that difficulty comparing products at physical stores was an annoyance, just topping the frustration over long checkout lines. That seems to suggest stores need to serve up more product information.

The obvious way this can be done is through Internet-connected kiosks and screens, but it’s unlikely customers will be impressed with capabilities that are similar to those they hold in their hands. Possibly it would be better to have in-store touch screens or smartphone apps preloaded with specific and easily digestible product specifications and intended usage. This information, ideally delivered by scanning a product code, must be well organized and quick to access – void of the scrolling, clicking and maneuvering of a smartphone Web search. In the longer term, the use of smart shelves, interactive displays and virtual sales assistance can address this shopper frustration. In the shorter term, sales staffs can be armed with tablets pre-loaded with product information and comparison presentations.

Waiting in line has never been popular with shoppers, and long checkout lines remain a frustration with GapGemini’s respondents. It won’t be a problem for too long, as stores that enable users to automatically self-pay through smartphone apps and mobile wallets are around the corner. At that time, the customer device essentially becomes part of the in-store IT infrastructure, pushing some burden of operations onto the shopper. In the nearer term, we’ll continue to see investment in mobile-checkout-enabled floor staff and, if theft issues are properly address, self-checkout stands. For smaller dealers, off-the-shelf services such as Square may be enough to get through the occasional rush.

Internet users also apparently want to see the type of personalization they see in the digital realm brought into the in-store experience. Sixty-five percent of respondents cited discounts and promotions not being personalized as a top in-store annoyance. This is one area, however, where physical retailers simply must emulate and incorporate the functionalities of online shopping. After all, the only way to personalize at scale is through customer data, and the very essence of IT centers on the collection, organization, analysis and cross-referencing of data. So unless shoppers are willing to fill out forms and employees are willing to crunch the information and keep it accessible, the most efficient ways right now to gather customer information are through purchase histories, search behaviors and social network activity. From there, data analytics provide the actionable output.

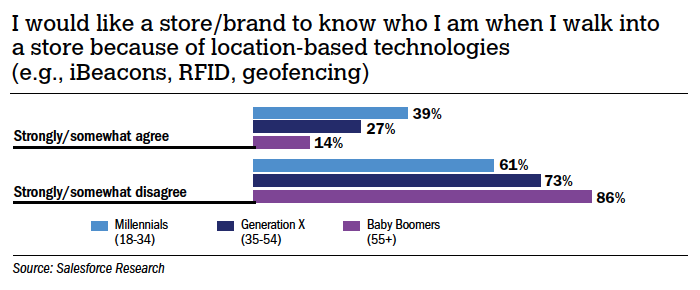

It should be noted that, while GapGemini’s respondents complain about a lack of personalization in the store, and a solid majority of consumers say they want and appreciate personalized offers based on purchase history, there is a limit to how “personal” shoppers want retailers to get. A survey of more than 4,000 North American shoppers by Salesforce Research suggests most consumers are uneasy with location-based technologies that alert retailers to who they are as they walk into a store. That includes 61 percent of millennials and 73 percent of Gen Xers. (Most people, meanwhile, can relate to that creeped-out feeling that comes when pop-up ads reflect a recent Internet search.)

Nonetheless, personalization was the top customer engagement priority for 2017 among retailers surveyed earlier this year by Boston Retail Partners, topping customer mobile experience alignment. Currently, just more than a third of retailers surveyed by BRP offer personalized rewards based on customer loyalty, while about a quarter offer suggested selling based on previous purchases. Top investment areas during the next few years include suggestive selling based on browsing history and social media activity.

Email is far and away the primary means of personalized messaging and promotions, but both eMartketer and CapGemini researchers feel retailers underestimate the role employees – ideally tech-empowered employees – can play in providing a personal experience.

“As the world continues to evolve and become more digitally advanced,” say eMarketer analysts, “it’s important to have some human contact, and store associates add to that personalized element.”

Store employees also can be a big help dealing with another in-store frustration among an equal 65 percent of Internet users. As store assortments widen and everyday lives become increasingly over-scheduled (or are at least perceived that way), shoppers apparently have less patience for browsing. We see this in the decline of impulse purchasing and foot traffic. It’s also apparent in the two-thirds of Internet users who cite the inability to locate products as a top annoyance when shopping a physical store.

Of course, there are tried-and-true, “low-tech” ways retailers can attack any store navigation pain points. Helpful staff and improved signage go a long way. At the other end of the spectrum, a cool augmented reality smartphone app can turn an annoying product hunt into a loyalty rewards game. A bit nearer-term for most is a floor map to the smartphone, preferably interactive over static. Likely even more impressive are digital and interactive maps and signage that keep the customers’ smartphones in their pockets (and the retailer in charge of the experience). Digital display maps also could be configured to deliver promotional messaging quickly – either seasonal or at a moment’s notice. Add in traffic flow analysis and the placement of maps and messages can be optimized for better store navigation.

Leading retailers are all-too familiar with the next in-store frustration, and it’s why we’ve seen emphasis placed by retail CIOs on tech-enablement of employees. More than six in 10 of those surveyed by GapGemini list a lack of guidance and demos from in-store associates among their top frustrations. It connects directly back to one of the main perceived benefits shoppers see in coming into a store: human contact and the ability, if I want it, to interact.

And when I do engage a floor staffer, that employee better be more informed than me (and hopefully more than Amazon), but surveys suggest customers don’t feel that is the case. More than eight in 10 shoppers recently surveyed by retail app provider Tulip Retail believe they’re more knowledgeable than retail store associates. All the while, 79 percent of survey respondents say knowledgeable store associates are “important” or “very important.”

There’s only so much technology can do here. Good employees, quite simply, will always be a product of hiring, on-boarding, pay, retention, local hiring pool, etc. (at least until the robots come), and those who do HR right tend to prosper. Nevertheless, we expect to see continued investment in the mobile empowerment of floor staff. That’s largely because customers can enter a store with more information than ever could be learned and retained by one person, no matter how much product training and sales instruction they’ve received. From pre-visit research, customers can know about prices, product availability, purchase history, reviews, color options and delivery dates. If they ask for help from an employee, anything less than that is less than impressive.

Ultimately, the in-store experience is the product of a slower time; a time when seeing folks at the general store was an important social exercise and browsing aisles was a past time. So it’s not surprising that a reboot is in order.

The good news is today’s technology often is delivered in whole new ways. Cloud-based deployment and as-a-service delivery mechanisms are democratizing all sorts of IT resources, including some cutting-edge stuff. What was once a capital intensive endeavor that required some internal expertise is now a fully managed service delivered securely, with high availability, from a provider’s hosted facility. What once meant a heavy upfront investment becomes a monthly recurring cost that can include maintenance, management and upgrades (no worries about obsolescence).

At the same time, consumers seem to be telling us, at least in surveys, that when they are going to spend their money, they want that “real” experience of physical touch and firsthand sight, of human connection and immediate gratification. So there may be limits to how much “digital” they are ready to have introduced into that space. There’s less question about online “smarts.” Consumers already bring the information, endless aisle and instantaneousness of online commerce into physical stores. Those stores better be ready to handle it.

This article is sponsored by: Kovea

VIEW ARTICLE

SUBCRIBE TO MAGAZINE

About Inside Outdoor Magazine:

We know outdoor executives have access to plenty of instantaneous information. But one thing decision makers overwhelmingly tell us they can’t get enough of is thoroughly researched and highly scrutinized news and analysis that can be applied directly to improving day-to-day operations.

Having surpassed more than a decade in the industry, Inside Outdoor Magazine’s staff of seasoned outdoor journalists represent years of experience in specialty retail, product manufacturing, business analysis and living the outdoor lifestyle. We believe this mix of backgrounds is a key component to complementing your marketing message with the business modeling, cost-margin analysis, trend forecasting and quantified operational advice that’s already proven to capture loyalty and engage readers, and studies show that reader engagement with media and advertising can drive sales.

Your customers would need to expend significant time and money to amass the information and advice, in addition to, the requisite industry movements, trends and product innovations—that we deliver straight to their mailboxes, for free, all year round.