Maturing Millennials – As the Echo Boomer generation grows up, so should marketing strategies.

by: Martin Vilaboy

During the past 10 years or so, as marketers outside and inside of the outdoor industry have diligently worked to understand and entice millennials, something that should’ve been expected has been taking place. The Millennial generation, quite simply, has been growing up. Depending on whose definition one uses, millennials currently can be anywhere 16 to 40 years old, with the more commonly accepted ages falling closer to 18 to 34 years old, or born somewhere between 1998 and 1983.

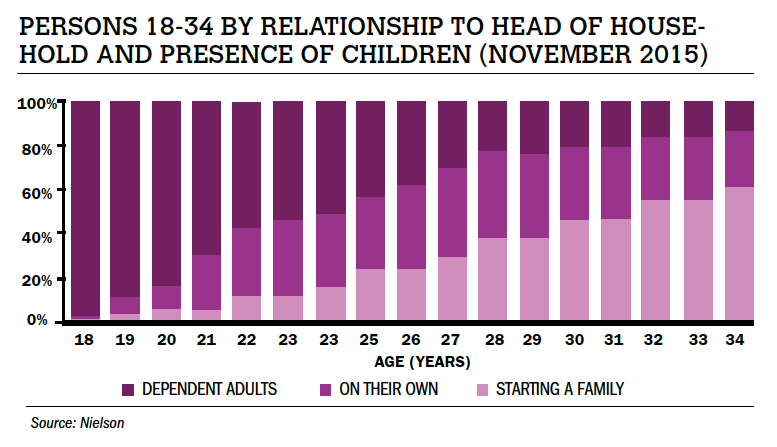

By all measures, the realities for someone entering college (18-year-olds) are vastly different from someone climbing the career ladder or building a family (thirtysomethings), so it’s errant to think of millennial as a uniform, homogeneous group with a common set of beliefs and behavior, say researchers at Nielsen. Nielsen, for its part, has begun breaking the cohort into three distinct groups – “dependent adults” (living with parents), those “on their own” (in their own home without kids) and “starting a family” (in their own home with kids) – and notes distinct behaviors between them. In other words, lots of millennials have moved or are moving from the years of freedom and perceived independence to the years of structure and responsibilities. In turn, it might be time for common notions and assumptions about millennials likewise to grow up.

It falls under an age-old question within product development and marketing. Will patterns and behaviors adopted during youth carry over into adulthood or will behavior conform to the demands of adulthood? It’s often assumed that millennials are somehow different; that they will forego the consumptive paths and binds that tied down previous generations. We have pictures of childless hipsters with alternate careers and the freedom to travel or the 30-year-old content to live in his parent’s basement. Mounting evidence, however, suggests many millennials, as they age, have rather traditional goals and aspirations, so marketers may have to reconsider how messaging remains relevant as more and more millennials move into adulthood, and even middle age.

The point isn’t too diminish the unique circumstance under which millennials were raised and how those circumstances make them unique to other generations. Certainly, millennials have come of age during a time of exceptional transition. The ubiquitously connected smartphone alone has changed the way we think, consume, communicate and create. And that reality has made millennials unique in their own right. On the other hand, there is nothing unique about living through transformational times. When radios and later televisions, for instances, conquered every living room, our collective perspective suddenly went from local news to globally informed. The rise of the automobile changed our daily routines and literally the pace of everyday life. When teenagers first became a targeted consumer market in the 1950s, an entire culture and voice was born. My own father, likewise, remembered the day when a lightbulb was first hung from the ceiling of his home. (I can hear the voice of parents past, “Little Manny is always tied to the lamp reading those books. In my day we had to make up our own stories in the dark.”)

Chances are good millennial moms and dads eventually will same similar things – which they never thought they’d say – to and about their own kids, as well. And yes, despite conventional wisdom, millennials will and are starting families. According to one study by online brand outreach platform Crowdtap, more than 60 million millennials — about 80 percent of the generation — will become parents in the next decade. Sure, millennials are having kids later in life than previous generations, but that’s a trend we’ve been witnessing for decades, with the average age of mothers at first child rising from about 22 years old in 1979 to just over 26 years old today, show U.S. Department of Labor and Commerce figures.

RELATED: IO Report: Social Studies

Currently, about six in 10 millennials above the age of 31 fall into Nielsen’s “starting a family” subset, or are living in their own homes with children. That may sound like a lot of older millennials are without children, but consider a 2010 survey by the Center for Work Life Policy which found that 40 percent of Generation X women between the ages of 41 and 45 years old also didn’t have kids, while 36 percent of Gen X men were childless by age 40.

According to Pew figures, there are about 14 million millennial moms in the U.S., which explains why retailers such as J.C. Penney’s, Target, Walmart, Kroger and Whole Foods have been adapting strategies to appeal to this group.

In the early part of last year, Target CEO Brian Cornell and other top executives traveled to major cities across the country to visit the homes of young, single and urban mothers. This customer group, said Cornell, has become as important to the retailer as minivan-driving, soccer moms were in years past.

J.C. Penney’s, meanwhile, says millennial moms now account for 45 percent of its revenue and are driving much of the growth in the company’s sales and customer count. “We want to be able to deliver her needs both as a woman and as a mother,” Sheeba Philip, J.C. Penney’s vice president of marketing strategy and communications, recently told CNBC. “That’s a huge unmet need.”

At the same time, the 18- to 34-yearold generation is generally known for renting homes instead of buying and spending on experiences over material goods, but that likewise is starting to change as more millennials grow up, become parents and trade in happy hours and vacations for houses and cars.

Once again, while current 18- to 34-year-olds boast the highest rate of living with their parents since the 1940s, surveys suggest millennials’ aspirations to own homes are very much in line with their parents’ and grandparents’, and the tendency to avoid homeownership is more about economic reality than cultural whim.

“Evidence from Fannie Mae’s National Housing Survey suggests that many renters aged 18 to 34 see their current ability to own, not a lack of desire to own, as the primary reason they remain renters,” wrote Douglas Duncan and Sarah Shahdad of Fannie Mae for Bloomberg Briefs.

“In fact, their desire eventually to own their own homes is no different from that of their parents and previous generations,” they continued. “Most millennial renters tell us that they think owning makes more sense than renting from a financial perspective: because you’re protected against rent increases and owning is a good investment over the long term.”

Duncan and Shahdad also note, that while “historically high numbers” of young adults are living at home (about 13 percent of Americans aged 21 to 34 live as the other adult in a shared household, per a survey done by UBS economists), the reasons behind it are to either keep college costs low or save money for forming their own households.

Even so, Fannie Mae’s latest housing survey found that 96 percent of millennials are optimistic they will eventually own a home, and many millennials seem to be actively working toward this goal. Those surveyed most often say that their primary reason for renting now is to prepare financially for homeownership in the future.

And that time may be coming sooner than later. Unemployment rates among those between 25 and 34 years old have plummeted the past few years, from 10 percent in January, 2010, to 4.8 percent in November, 2016, and with it we have seen an uptick in household formations, shows data from the federal government.

Indeed, Jeffrey Mezger, CEO of one of the largest homebuilders in KB Homes, said in a recent earnings call that first-time home buyers and young people are beginning to enter the market, driving demand for his business. A recent report from strategy firm Forrester likewise shows that in 2013, the percentage of households owned by someone under the age of 25 years was at 14 percent, up from 9 percent for the same cohort in 1973.

RELATED: IO Report: Fiber Optics

It should also be noted that the median age for first-time homebuyers has remained virtually unchanged for the past 40 years. According to data from the National Association of Realtors, it was 31 years old in 2015, compared with 30.6 years old in the early 1970s. In other words, about two-thirds of millennials haven’t yet reached that home buying age of 31, and about a quarter are under the age of 25 years old. Again, this isn’t to diminish the ways in which millennial priorities and realities are unique to previous generations. All generations are unique, and Generation Z will likely bring entirely new characteristics to marketers’ attention. Rather, it’s an acknowledgment of how younger generations are almost always viewed by their elders as “different,” if not “weird and demented.” So we have to wonder how much of millennial behavior, beyond new-technology-driven differences, so far can be attributed largely to youth, or the realities and perceptions of youth versus those of adulthood.

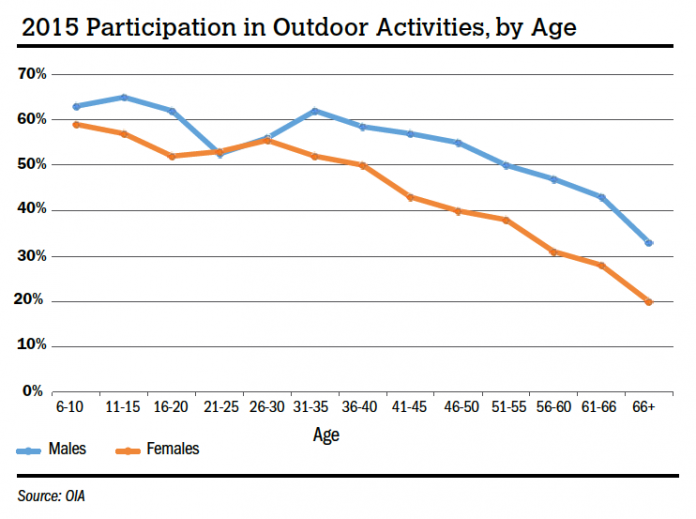

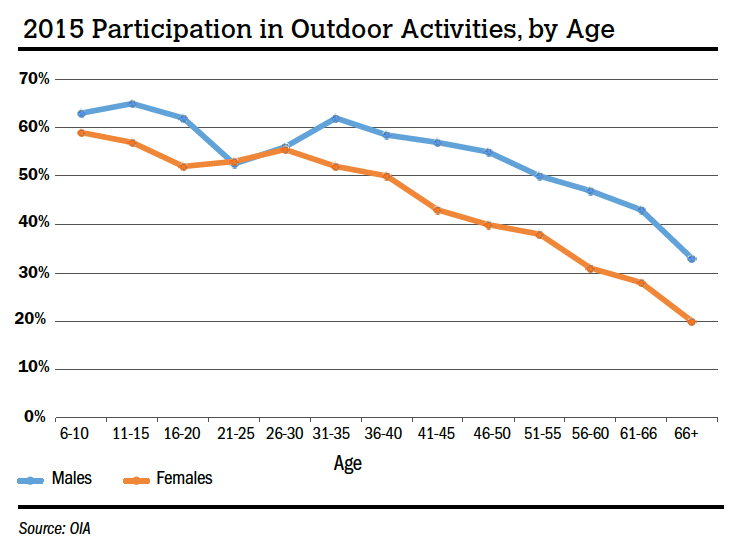

Nonetheless, the possibility of America’s largest generation settling into homes and having children could be great news for outdoor participation. For starters, the rate of participation in outdoor activities among U.S. female adults hits a peak around the ages of 26 to 30 years old. For adult males, participation rates peak around 31 to 35 years old, show the Outdoor Industry Association’s latest figures. OIA data also shows that adults with children in their households participate in outdoor recreation at a higher rate (54 percent) than adults without children (40 percent), and parents with children ages six to 12 participated at a slightly higher rate than parents of other aged kids. Make no mistake, huge numbers of potential participants will be added to those age groups as millennials age.

What’s more, it’s been pretty well established that most people initially get introduced to outdoor activities by their parents, so a growing base of millennial parents brings with it a growing group of potential, young participants. And it shouldn’t be hard to make the case to new and concerned millennial parents how nature-based time and recreation positively impact childhood development.

Studies have shown that children who spend time in natural or “green” settings not only are fitter and leaner, but they develop stronger immune systems along with reduced cases of myopia (near sightedness), play more creatively, test better in school, are more socially adjusted and deal with stress better. Research published in the American Journal of Public Health also linked outdoor activities to reduced ADHD symptoms.

Already within the industry, there is a movement to position outdoor recreation as preventive health care. Blue Cross Blue Shield of Alabama and BlueCross BlueShield of Tennessee, as examples, are sponsoring content on RootsRated in their respective states in the hopes of encouraging subscribers to get outside and be active, thereby helping to reduce many common health ailments compounded by lack of exercise. Similarly, a recent article in National Geographic highlighted Dr. Nooshin Razani, a pediatric physician at Children’s Hospital in Oakland, Calif., who has noted a connection between nature experiences and health. Nooshin is training pediatricians in an outpatient clinic to write prescriptions for young patients and their families to visit nearby parks. No doubt these are compelling messages to a group of consumers whose priorities are shifting from self-expression and wanderlust to rearing healthy and happy offspring.

No doubt these are compelling messages to a group of consumers whose priorities are shifting from self-expression and wanderlust to rearing healthy and happy offspring.

VIEW ARTICLE

SUBCRIBE TO MAGAZINE

About Inside Outdoor Magazine:

We know outdoor executives have access to plenty of instantaneous information. But one thing decision makers overwhelmingly tell us they can’t get enough of is thoroughly researched and highly scrutinized news and analysis that can be applied directly to improving day-to-day operations.

Having surpassed more than a decade in the industry, Inside Outdoor Magazine’s staff of seasoned outdoor journalists represent years of experience in specialty retail, product manufacturing, business analysis and living the outdoor lifestyle. We believe this mix of backgrounds is a key component to complementing your marketing message with the business modeling, cost-margin analysis, trend forecasting and quantified operational advice that’s already proven to capture loyalty and engage readers, and studies show that reader engagement with media and advertising can drive sales.

Your customers would need to expend significant time and money to amass the information and advice, in addition to, the requisite industry movements, trends and product innovations—that we deliver straight to their mailboxes, for free, all year round.