The desire to “go shopping” hasn’t subsided, suggest findings from GlobalWebIndex. It’s just been put on hold.

“In fact, emphasis on online shopping throughout this time may have contributed to a newfound eagerness to shop in-store once again,” writes Tom Morris, GlobalWebIndex analyst.

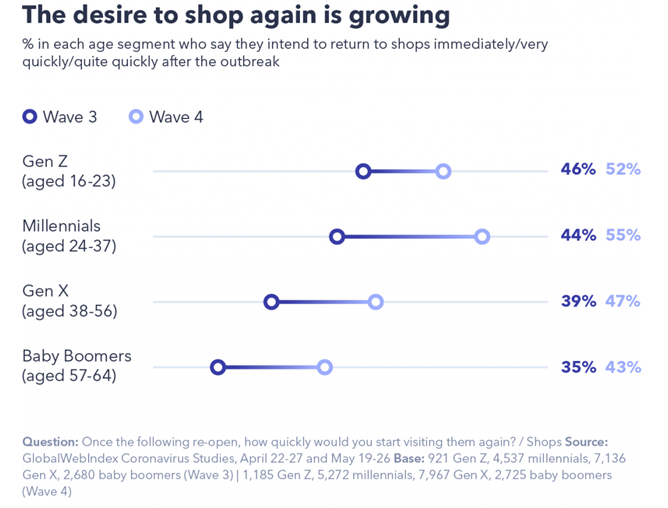

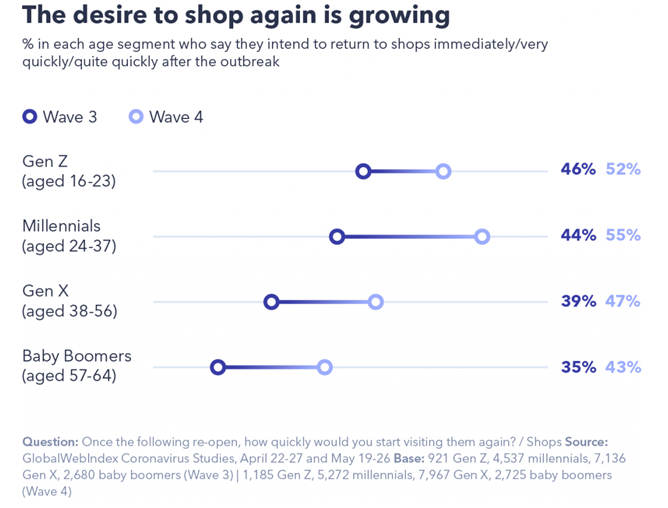

More than half of all internet users from wave 4 of GWI’s coronavirus study fielded in May say they intend to return to the shops immediately, very quickly or quite quickly, having climbed from just more than four in 10 in March’s wave 3 study.

Largely, it’s younger audiences who are most hungry to return to stores, show the GWI data. More than half of Gen Zs and millennials share this sentiment; but baby boomers aren’t too far behind – their intention has actually climbed at the same rate as Gen Z.

“With older audiences generally considered to be at greater risk, a simple explanation for the gap between generations could be a concern for safety. But this isn’t necessarily the case,” Morris pointed out.

Safety is a concern shared quite generally, with regular cleaning of public spaces (68%), social distancing measures (58%), provision of hand sanitizer (57%), and mandatory usage of face masks (53%) considered the all-round most important factors to individuals.

In fact, when asked about the importance of getting back to normal, 79% of baby boomers say it’s important that brands do so, with figures descending with age – compared to 73% of Gen Zs.

Instead, it’s more likely that older audiences’ enthusiasm for in-store shopping is tied to their lesser likelihood to shop online – 70% of baby boomers purchased a product online in the last month, behind the average 74% of internet users globally.

While the desire for shopping is present across all age groups, there are some notable caveats between markets, show the GWI data. In general, recovering countries or those less affected by the outbreak are more likely to express a desire to return to shops – such as Poland (72%) or Australia (66%) – while countries worst hit are less eager, such as Italy (38%) or Brazil (35%). Consumers in the latter appear to be more psychologically wounded by the outbreak, and less inclined to revisit shops as a result.

“Though it’s likely in-store purchases are going to experience a rebound soon, it’s important to remember that online purchases aren’t likely to experience a sharp decline in response,” Morris concluded.