Opportunities and forecasts for holiday 2020

One of the initial steps to forecasting a holiday shopping season is to analyze results and trends from the previous year. Not so much in 2020. As with most things in life this calendar year, the realities of late 2019 could be irrelevant to late 2020, and the holiday shopping season could be like none we’ve seen before.

Of course, that doesn’t mean all logic and reasoning go out the window when predicting market trends and shifts. Looking back at the back-to-school season, for example, armed with the benefit of hindsight, many of the shifts in spending that occurred made absolute sense. As parents had to shuffle to prepare for kids learning at home, spending on traditional “school supplies” and trendy apparel took the hit, show NPD Group figures. Segments that gained the most included laptops and electronic accessories, textbooks and educational apps for at-home use, home-schooling tools, Wi-Fi routers and higher-speed bandwidth services. In other words, no real surprises here.

Similar to back-to-school, the holiday 2020 shopping season is setting up to be a more virtualized and “home-based” experience than anyone expected back in the alternate reality of 2019. When all is said and done, retailers should not be surprised to see several years’ worth of growth in online and omni-channel shopping behaviors squeezed into this one upcoming season. And with retailers and retail supply chains still recovering from shutdowns and the subsequent slowdown in new IT projects, customer demands and expectations could strain current supply chain and fulfillment capabilities. The end result could be large numbers of holiday customers suddenly up for grabs, as they search for gift ideas.

Certainly, if the weather is nice this winter, and stores can safely return to somewhat regular operations, many Americans will be itchy like an old Christmas sweater to get out, browse festive displays and physically celebrate the end of 2020 after nine months when restrictions and cancellations of large gatherings kept them inside and interacting virtually. Unless we take drastic steps back in our battle with COVID-19, the majority of sales once again will occur within the four walls of stores.

Steps Retailers Are Taking to Add Safety to In-Store Holiday Shopping

| Taking extra precautions to keep shoppers safe | 81% |

| Not hiring extra staff or bringing back previously laid off employees | 70% |

| Offer curbside pickup | 46% |

| Make masks mandatory | 45% |

| Implement social distancing guidelines | 45% |

| Increasing online inventory | 43% |

| Apparel retailers offering alternatives to fitting rooms (i.e. digital sizing tools) | 39% |

| Implementing cashless payment in-store | 34% |

| Offer hand sanitizer | 34% |

| Make products available to buy on social media app | 31% |

Source: Paypal

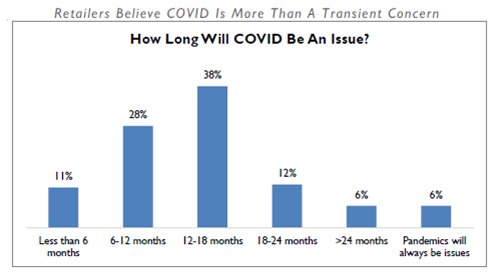

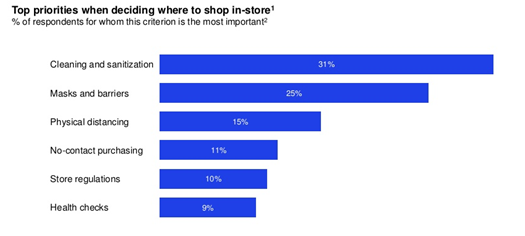

But as normal cold and flu seasons return amid warnings of a “twindemic,” many shoppers still will be reluctant to brave large, possibly crowded public areas. In a large survey of U.S. shoppers this summer by rewards app Shopkick, for example, three quarters (77 percent) of shoppers said they expect to buy holiday gifts online to avoid crowds and exposure. That’s a 16 percent increase from 2019, when 51 percent of shoppers told Shopkick they expected to make holiday purchases online to avoid crowds. Among respondents to a separate July survey from Qubit, a provider of merchandising and personalization technology, 44 percent said they plan to shop more online during this year’s Black Friday, Cyber Monday and Christmas holidays as compared to last year’s holiday season. Less than 30 percent said they feel comfortable returning to stores, with nearly one in five not expecting to return to stores until 2021.

“Our survey data shows that shopper behavior has changed radically since the pandemic spread globally and will continue to look different during the 2020 holiday season,” said Graham Cooke, CEO and founder of Qubit. Indeed, even the thought of kids lining up to sit on Santa’s lap still will be uncomfortable for many come December.

“It’ll be interesting to see if stores even have Black Friday sales or are open on Black Friday,” said Randy Hare, portfolio manager at Huntington Private Bank, in a late-August report by Reuters.

“I don’t think anybody is going to be open for Thanksgiving, and I think we’re going to see limited store hours throughout the season,” agreed Gabriella Santaniello, founder and CEO of retail research firm A Line Partners.

At the same time, several ecommerce shopping behaviors – many of which were already emerging healthily the past few years – suddenly received a massive push in market momentum. Almost overnight, mainstream awareness was driven toward all sorts of digital, omni-channel and gig-economy-based shopping enablers – ranging from the initial search and discovery process all the way to last-mile, third-party fulfillment.

Source: Retail Systems Research, August survey

According to U.S. Census Bureau reporting on the second quarter of 2020 – the first quarter that felt the impact of the pandemic in its entirety – total retail sales declined 3.9 percent from the first quarter, while e-commerce sales increased 32 percent. One indication of the transfer of dollars that took place due to COVID-19, U.S. shoppers spent more online in April and May of this year ($153 billion) than they did during November and December of 2019 ($142.5), according to analysis by Adobe. The recorded online spending was $52 billion more than what retailers typically see during April and May.

“We expect ecommerce to retain this increased share of the retail market after lockdowns are lifted,” said Nina Goetzen, eMarketer junior analyst. “The pandemic has only accelerated an ongoing shift to the channel.”

“It is tempting to chalk this up to a temporary impact of the pandemic,” agreed Simeon Hyman, global investment strategist at ProShares, “but there are signs that this pandemic is accelerating existing long-term trends and furthering opportunities for e-commerce growth.”

One glaring example, said Hyman, e-commerce food and beverage sales increased more than 100 percent from the first quarter, and more than 220 percent over the second quarter of last year. Given that half of merchants (52 percent) recently surveyed by Paypal are still unsure whether consumers will use fitting rooms to try on clothes, nearly forty percent are offering virtual alternatives. This includes online fit or sizing tools (26 percent), virtual showrooms (23 percent) and virtual stylists (23 percent).

Analysis by Salesforce, meanwhile, found that orders through social channels were up 104 percent for the second quarter, and revenue at BOPIS-related sites was up 127 percent. And by the middle of this summer, only 17 percent of the 17,000 U.S. consumers polled by Shopkick said BOPIS would not be part of their holiday shopping. More than four in 10 said BOPIS would be.

“Black Friday lines won’t disappear, but we expect lines of consumers waiting for store openings will be replaced by long queues of cars eagerly waiting for buy online, pickup curbside purchases to be placed in their vehicles,” said Stephen Baker, vice president, industry advisor for The NPD Group.

Most years, including in 2019, low prices are the most important incentive for holiday shoppers, “but with more shopping online this year,” said Shopkick researchers, “the majority of consumers (54 percent) are most incentivized by free shipping.” Just less than a quarter now believe low prices is most important.

Source: McKinsey & Co.; June 2020

All told, analysts for Saleforce predict online sales will account for 30 percent or more of total holiday spending in 2020. That would be about double the percentage of online spending (non-gas and non-grocery) tallied by Salesforce in holiday 2019.

Folks won’t just be buying online, either. Even larger than the growth in dollars spent will be the increase in search and discovery time taking place in digital spaces. Whether a transaction is home delivery or BOPIS or “see online, grab my mask and get in and get out” or even “see what’s out there but still browse the store aisles,” a large chunk of transactions start with digital discovery (the younger, the more on mobile). In turn, we can expect to see accelerated growth in the use among retailers of digital and social channels for marketing and customer acquisition. Some popular themes expected to proliferate in holiday 2020 marketing include gift suggestions; safety measure taken to keep stores virus-free; the availability of curbside, BOPIS, appointment shopping and other low-contact or no contact buying methods; and the comfort of familiar holiday traditions during disruptive times.

“Overcommunication matters so much right now,” said Brendan Witcher, vice president and principal analyst at Forrester Research. “If you’ve got customer testimonials about how [BOPIS and curbside] options have helped them out … overemphasize how you’ve made the world safer for your consumers.”

Down the Chimney

After customer attention is gained, and shopping carts not abandoned, it’s looking highly unlikely that supply chain issues initiated by coronavirus-related shutdowns will be normalized in time to satiate the coming rush of gift seekers. The National Retail Federation, for example, recently forecast a 9.4 percent decline in total container imports for the year, while as recently as August, 91 percent of outdoor companies surveyed by the Outdoor Recreation Roundtable reported ongoing disruptions to production and distribution. In other words, make no mistake, lots of holiday shoppers will encounter the dreaded “out of stock” message. Consumers’ recent widespread experiences with product shortages at retail only add to any gift-buying panic.

Consider, for example, a mid-summer poll by Mckinsey & Co. that asked shoppers about their decisions to try new brands during the past three months. The number one reason for switching brands was simply because “products were in stock,” followed by “is available where I’m shopping.” A “better price” or “better value,” typically a top factor in brand attrition, came in third and fourth, respectively.

Source: McKinsey & Co.

At the same time, shoppers will be faced with “holiday shipping surcharges” and expected delays in deliveries. Indeed, the major parcel carriers have made it pretty clear that they expect the coming rush on holiday shipping to stretch their capabilities. Word has spread of possible restrictions on shippers, and while “Uber-ized” employees and gig-drivers can make up some of the slack, Salesforces predicts as many as 700 million packages are at risk of being delayed this holiday season, even more if waves of COVID-19 cause fulfilment centers to shut down.

“We know that online shopping picks up over the holidays, and the system is already pressed to meet that sort of demand,” said Mark Mathews, vice president of research at the NRF. “If you’ve got a situation where you’re adding another 10 or 20 percent to that, which is well within the realm of a possibility, that creates real challenges.”

If these two winds collide and spiral, retailers will encounter an abundance of desperate and frustrated shoppers frantically searching for something, anything, to replace the “perfect gift” that proved harder to get this year. The brands and retailers that can ease the pain of these holiday headaches with thoughtful gift suggestions and the ability to deliver goods, especially later in the season, will be widely welcomed and rewarded.

Retail’s Dark Side

Not that it will be easy. The pandemic and reactions to it have greatly hastened the digitization of retail. We may not be seeing anything “new,” per se, but certain behaviors became “normal” sooner than most expected. BOPIS and curbside are now mainstream concepts; personalized and appointment shopping became a familiar lockdown strategy; discovery shifted almost entirely to the web for a period of time, and folks started buying lots of things online that they used to buy solely or mostly in-store. Omni-shopping is suddenly full on.

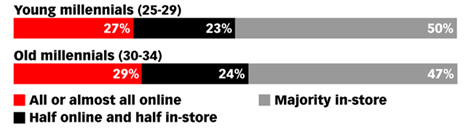

Even before the pandemic pushed e-commerce spending, retail non-gas/non-grocery spending was fragmenting into three general categories. According to a 2019 survey by CivicScience of more than 5,000 U.S. consumers, about half of millennials do a majority of their shopping in-store. Just more than a quarter shopped all or mostly online, and just under a quarter said they shop half online and half in real life. Recent events suggest more will now fall in the latter two categories, so only a very specialized business can survive without serving all three. Maybe it’s sooner than some expected, but welcome to the market fragmentation that’s often part of a digital transformation.

Millennial Shopping by Channel, 2019

Source: CivicScience, June 2019; Excluding grocery and pharmacy

For most physical retailers, meeting the expectations of all three segments will require investments in inventory transparency and management, as well as alternate “last mile” and fulfilment options. Since their inventory is on-hand and local, physical retailers can leverage their stores to “bypass the bottleneck” of e-commerce fulfilment, said Caila Schwartz, retail analysts at Salesforce. Target CEO Brian Cornell, likewise, said the retailer will stress same-day delivery and make thousands of additional items available via delivery and click-and-collect methods, including more gifts and essentials, during this “very different holiday season.”

For some physical retailers, an emphasis on curbside, pick-and-pack, local delivery and click-and-collect could be viewed as creeping toward the dreaded “dark store” model. In some ways, that’s true. In other ways, omni-channel shoppers, starting with this holiday season, simply will demand dark store-type fulfilment options.

“These service elements will be key to winning the upcoming holiday season,” said retail consultant Deepak Agarwal

One of the biggest adjustment retailers might have to make in reaction to the events of 2020 is a shifting of holiday hiring from sales floors and restocking duties to pick-and-pack activities, curbside fulfilment, online shopping advisors and same-day delivery drivers, as well as in-store cleaning and disinfecting.

“A lot of holiday preparation used to be around building sales staff, warehouse staff and staff to deal with traffic,” said Daniel Binder, partner at Columbus Consulting. “Now it’s more about how stores are going to be used in addition to what traffic circulates the fulfillment center. A lot of staff in-store will be fulfilling orders very differently than they were 12 months ago.”

Dick’s Sporting Goods certainly benefited from its choices to boost BOPIS capabilities and focus on fulfilment when in-store operations were limited or forced to shut down back in the spring, as e-commerce sales skyrocketed for the Pennsylvania-based retailer during the period April to June. Online sales, including curbside pickup, grew 194 percent year-over-year, while Dick’s digital sales accounted for about 30 percent of total revenue during the quarter, the company reported. And while 15 percent of Dick’s brick-and-mortar stores were closed during the quarter, sales at stores that have been open at least 12 months rose 20.7 percent from a year ago. Overall, net sales increased 20.1 percent year-over-year, to $2.71 billion.

The Creep Continues

As another means to countering in-store traffic restrictions and online crunches, many retail consultants and experts are suggesting retailers “spread out the holiday season,” such as starting early, planning for post-holiday shopping activity and spacing out promotions.

“It can’t be a blitz of every single product you have online. Let’s pick and choose,” warned Scott Sureddin, DHL supply chain CEO for North America.

Retailers that go too heavily too early run the risk of holiday fatigue, but spreading things out might be necessary for drawing some shoppers back. As of August, footfall in retail spaces remained at just a quarter of last year’s levels, data gathered by analytics firm Springboard showed, increasing only 5 percent since June. Major brands such as Kohls, Target and Best Buy have moved winter holiday promotions up to as early as October. Michael Brown, partner in the consumer practice at Kearney, pointed to “orange Sunday,” or the day after Halloween, as a type of new Black Friday.

“You can spread that demand out over a two-month period, and that will give you a chance to capture demand,” Brown advised. “It also will give you a chance to fulfill consumers’ orders for a much longer period and react if and when there are breakdowns in your system.”

To sustain engagement and interest over the longer season, researchers at RetailMeNot suggest, retailers will need to maintain an always-on yet flexible promotional calendar and continually monitor the pulse of gift shoppers, ready with flash sales and deep discounts to hook consumers searching for deals early and late. Recent RetailMeNot surveys found that 36 percent of shoppers plan to spread purchases out this gift-giving season, and 31 percent said they plan to shop early to avoid shipping delays or inventory concerns.

Similar to previous years of its survey, about a third of shoppers told Shopkick they plan to start shopping this holiday before Thanksgiving.

“Retailers and service providers should clearly communicate the importance of consumers acting early, using the online channel, and making sure goods are shipped early, as there will be an obvious strain on fulfillment,” said Marie Driscoll, managing director of luxury and fashion, at Coresight Research, during an August interview. “Retailers can plant the idea that while socializing might need to be virtual, gift giving can be solidly three-dimensional, with sufficient planning ahead.”

If it seems like it was just a year ago when brick-and-mortar retailers were being advised to advantageously leverage their floorspace through “experiential holiday activations” that encouraged shoppers to gather, admire and hopefully buy something, it was. Indeed, the events of 2020 have literally flipped the switch toward more virtual and crowd-controlled holiday shopping experiences.