Shoppers face opposing pressures as they head into BTS, Holiday 2022

After a crazy couple of years of shutdowns, shortages and mounting inflation, there’s plenty of uncertainty as to where shoppers’ heads are at heading into back-to-school/holiday 2022. It’s not that pundits and retail executives are worried. Most expect the full return to classrooms to spur small gains in BTS dollars this fall after the massive year-over-year growth in sales in 2021, while remaining pent-up demand to celebrate post-COVID will drive enough holiday spending, or “revenge buying.” eMarketer predicts an average, if not modest, 3.3 percent growth year-over-year in holiday spending following the double-digit growth experienced last year.

What’s less clear heading into the big shopping seasons is how reactions to new realities along with the memories of recent pain points will impact shopping behavior this autumn and winter. Earlier this year, for instance, management consulting firm McKinsey estimated that 80 percent of retail customers developed “new shopping behaviors” because of COVID-19, and one half of those will continue to use services such as buy-online-pickup-instore (BOPIS) in the future. In other words, “retailers need to prepare for the ‘next normal’ in holiday shopping and consumer expectations that are still changing,” said Rose Spicer, global head of retail marketing at Oracle.

It’s safe to expect a continued acceleration toward digital channels, which received a boost when stores were forced to shut down and/or limit access. It’s also quite likely shopper expectations have increased now that they’ve experienced the impressive accommodations and adjustment retailers made due to the unprecedented circumstances of the pandemic. And it’s safe to assume that higher costs for gas and groceries will forces consumer to be more discerning with their dollars than in the recent past. According to eMarketer, for instance, 84 percent of shoppers expect to see higher prices heading into the fall, with more than four in 10 back-to-school shoppers planning to do more comparative shopping online or shop for sales more often.

But in some ways, shopper behavior is simultaneously being pulled in completely opposite directions by current trends, headlines and economic conditions. While at the same time, the journey from discovery through purchase (and onto post-purchase) appears to be getting increasingly sophisticated, shopper surveys suggest.

YOY Shopping Season Estimates, $ Billions

| 2021 | % Change | 2022 | % Change | |

| Retail BTS season sales | $67.01 | 14.3% | $67.46 | 0.7% |

| E-commerce BTS season sales | $26.39 | 10.2% | $28.19 | 6.8% |

| Overall holiday sales | $1,221.82 | 16.1% | $1,262.14 | 3.3% |

| E-commerce holiday sales | $204.20 | 10.4% | 235.86 | 15.5% |

| M-commerce holiday sales | $93.73 | 14.6% | $112.03 | 19.5% |

Source: Insider Intelligence; eMarketer

On the one hand, shoppers could be feeling pressure to spend early and buy quickly. Certainly, inventory levels have greatly improved since the peak of the pandemic, with U.S. Census Bureau figures from earlier this year showing retail inventories at their highest levels since March 2018. NPD Group’s analysis of specialty retail channels, meanwhile, found that inventory levels as of April 2022, were 44 percent higher than they were pre-pandemic in 2019.

Even so, recent supply chain struggles, labor shortages and delivery delays experienced during the past two years are still bouncing around in consumers’ memories, and many shoppers across the country regularly encounter open spaces on grocery shelves that historically are filled with options. In turn, shoppers may be inclined to start their shopping even earlier than in the past and quickly pull the trigger on a purchase before that product is unavailable.

“Concerns about items being out-of-stock are continuing to drive consumers to shop earlier than ever, with 29 percent saying inventory concerns have caused them to shop for items at least a month before they need it,” said researchers at Quantum Metric, a provider of customer experience data analytics. That goes not only for dorm room supplies and Christmas gifts, “but for everything from Easter candy to Mother’s Day cards,” continued Quantum Metric, in its recent BTS retail benchmark report. “For back-to-school items, consumers are buying even earlier. In fact, 41 percent have either already started or plan to start before this school year even wraps,” the report continued. “Comparing traditional K-12 shoppers to college shoppers, we see that those looking for college essentials are more likely to start earlier.”

As of early July, more than half (56 percent) of shoppers had started shopping for school and college supplies, according to the National Retail Federation.

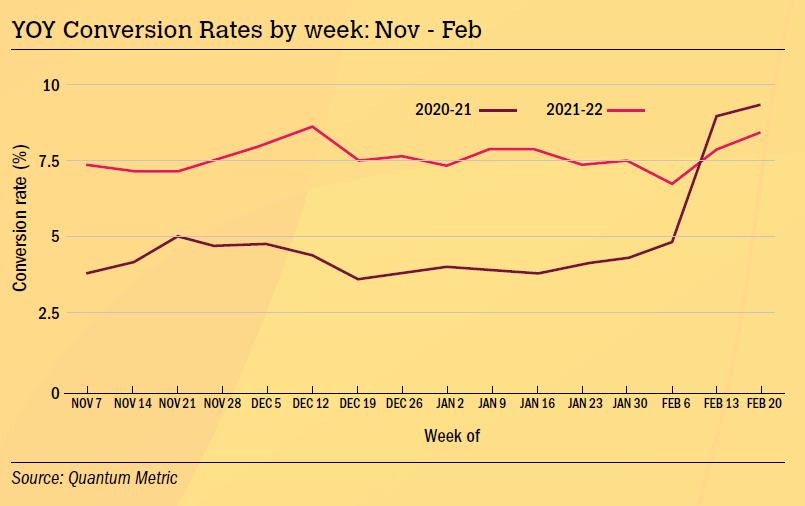

The pressure to purchase also is reflected in conversion rates, said Quantum Metric, which were consistently higher around last year’s holiday shopping season compared to the year before.

Inflationary pressures also could encourage hasty purchasing. With annualized prices rising every month on both wholesale and consumer goods, a gift for a loved one could be considerably cheaper to purchase and ship in September than in December.

“In order to accommodate tighter wallets, consumers will be on the lookout for deals early and often,” said analysts at Retail Touchpoints.

We can expect these early bird shoppers to be enticed by end-of-summer and pre-Black Friday promotions, with a good chunk of their spending getting gobbled up by the heavy discounting that’s expected by big-box chains and department stores looking to clear out inventory before the holidays really heat up. Indeed, eMarketer researchers expect the “Cyber Five’s” (Thanksgiving Day, Black Friday, Small Business Saturday, Cyber Sunday and Cyber Monday) share of holiday ecommerce sales will decline again in 2022, from 16.9 percent last year to 16.4 percent – well below the 2019 high-water mark of 20 percent.

Equal but Opposite?

Then on the other hand, inflation’s bite into discretionary spending and the higher costs of some goods

could extend the time from search to sale, forcing shoppers to be more patient in their purchasing. If dollars are at a premium come holiday, it stands to reason that consumer will be taking more care to ensure those dollars are being spent wisely. The temptation to “find a better deal” or “wait for a discount” could be strong.

The good news heading into the holidays come via a recent Kearney Consumer Institute

survey, which found that while 31 percent of consumers said inflation impacts them “very much” so far, consumers are focused on the price changes in categories such as groceries (88 percent) and gas (69 percent). By contrast, only 2 percent of consumers say they feel the biggest impact in popular gift categories such as toys, sporting goods and games.

Even so, analysis by Quantum Metric suggests shoppers are increasingly doing their homework before buying. More often than not, they journey across multiple channels in order to make a single purchase and are taking more time to actively seek information that validates their decisions. The bigger the ticket of the item, the more the purchase decision is being scrutinized.

For a plurality of respondents, patience is viewed as a virtue, as 46 percent say they now need more time to make a purchase. “For another 43 percent of consumers, it comes back to finding that lower price and waiting until they are offered some sort of discount code to make the purchase,” said Quantum Metric researchers.

All told, 76 percent of consumers say they are starting their shopping earlier specifically so that they can identify items they want and wait for them to go on sale, while a quarter said they are most likely to wait to purchase general classroom items until the very last minute.

In turn, shoppers are hungry for product and comparison information, data from Quantum Metric suggests, and they are willing to jump across channels and platforms to make sure they are getting the most for their money. A typical pathway to purchase nowadays could include discovery of an item on a mobile device that moves to a desktop for further research, followed by some price comparison back on the mobile and is completed in-store or back on the desktop.

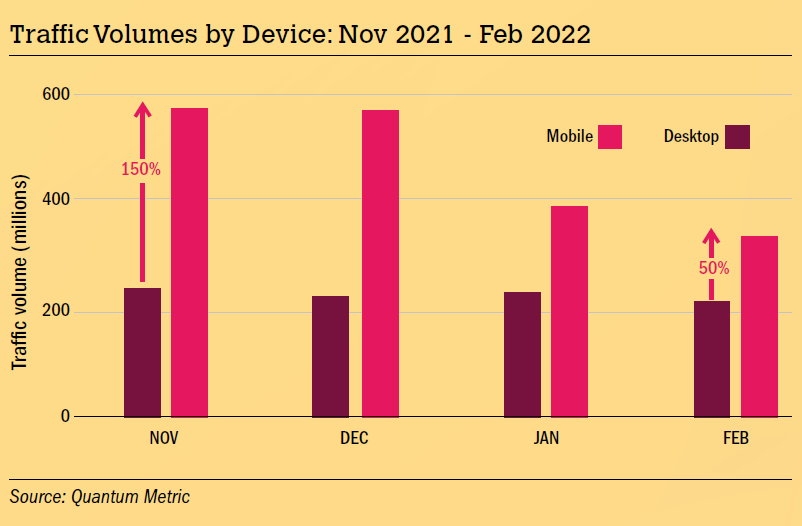

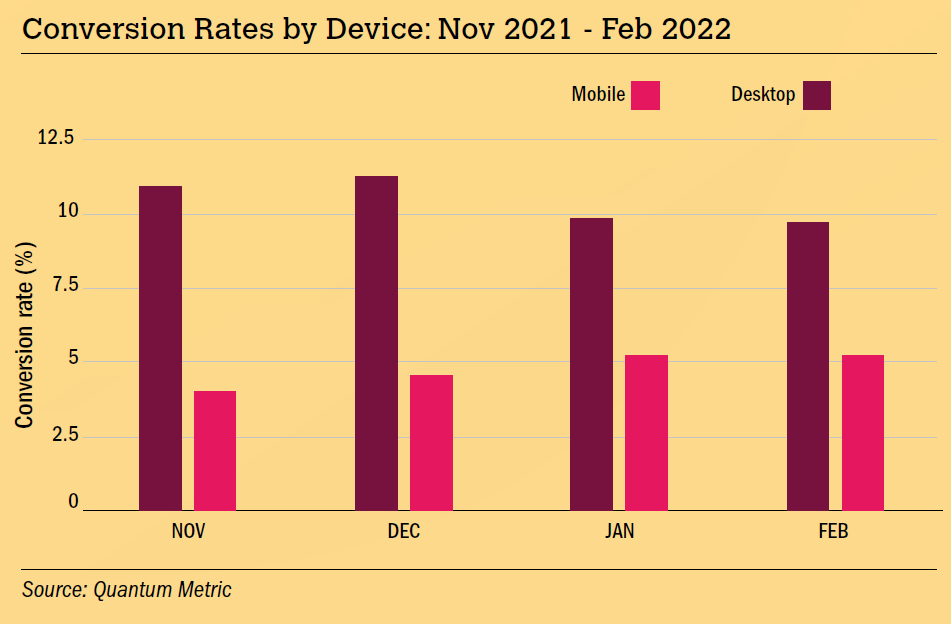

Make no mistake, the shift toward omni-channel shopping has accelerated. According to Quantum Metric’s analysis of online shopping experiences, mobile devices dominate traffic volumes, particularly around the holidays. When it comes to conversion rates, however, month-to-month rates for desktops is nearly twice as high as mobiles. Desktops also have a lower cart abandonment rate than mobiles.

“What we are seeing is that mobile shopping isn’t a clean one-stop experience. It is part of the much larger customer journey,” said the Quantum Metric report. “With consumers now taking more time to research and plan their shopping, we are seeing mobile used as a tool along the way.”

Even when an item is placed in a cart, and it would seem the heavy lifting is done, monthly cart abandonment rates have been up compared to year prior rates.

Analysts at Quantum Metric also are seeing more and more shoppers beginning to build wishlists of purchases they intend to make later. When asked, 39 percent of consumers estimated they build one to two wishlists a month, and 28 percent say they build one to two lists per week. And while the intent to purchase is certainly better than none at all, when an item sits on a wishlist, there’s certainly a chance the shopper is keeping an eye out for a better price somewhere else or a better deal on something similar.

“The majority of consumers building wishlists have some intent or interest in purchasing the item, just not right away,” said the report. “For 43 percent of consumers the decision to make a purchase depends on what they can afford, a trend we will continue to see as a major factor in light of recent inflation.”

One thing is for certain, retailers are in for a long BTS-to-holiday shopping season. Activity will start earlier than ever while consumers also could be more patient than ever. Clearly, there are reasons why shoppers might want to grab what’s on the shelf before it’s gone or something like a railroad strike further strangles supply chains. But talk of inflation, recession and layoffs will pressure shoppers to wait for end-of-season deep discounts or new information that might verify their decisions or change their minds.

Either way, shoppers certainly are utilizing the choices of channels and platforms that are available to them in the new omni-channel realm. Retailers that provide adequate information across all channels and work to instill confidence that a product is worth the price, will increase their chances of having happy holidays.

That’s largely why three-quarters of retailers surveyed by marketing analytics company Vericast said they need to give consumers stronger reasons to purchase. A full 81 percent of retailers said consumers are looking more for deals and discounts.

“People are willing to spend,” said Vericast analyst, “but retailers need to give them a reason to splurge — now more than ever.”