PayPal Holdings, Inc. today announced Pay in 4, a short-term installment offering for customers in the U.S. PayPal said Pay in 4 can help merchants drive conversion, revenue and customer loyalty without taking on additional risk or paying any additional fees, while enabling consumers to make a purchase and pay over four, interest-free installments.

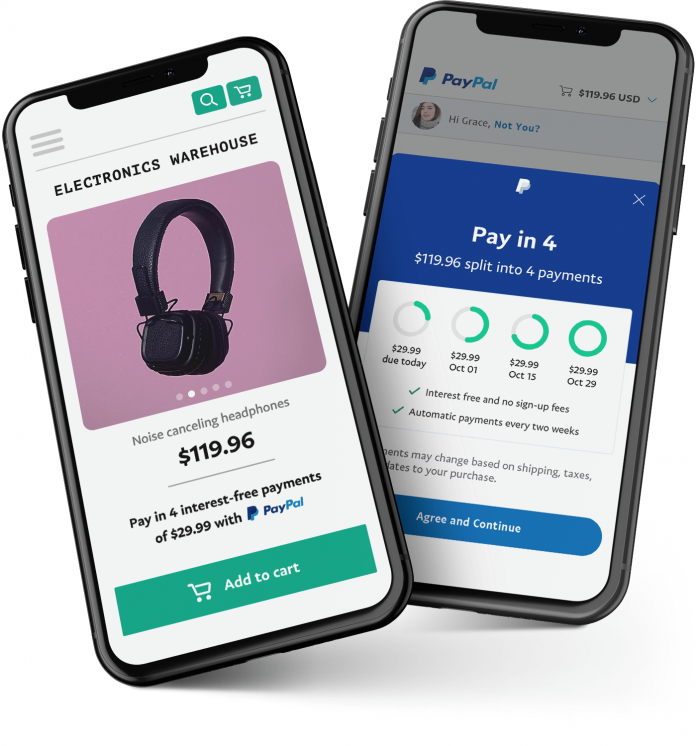

Pay in 4, which is part of PayPal’s growing suite of Pay Later solutions, enables merchants and partners to get paid upfront while enabling customers to pay for purchases between $30 and $600 over a six-week period. Pay in 4 is included in the merchant’s existing PayPal pricing, so merchants don’t pay any additional fees to enable it for their customers. Consumers pay no fees1 or interest, and payments are seamless with automatic re-payments. Pay in 4 will also appear in the customer’s PayPal wallet, so they can manage their payments in the PayPal app.

The PayPal platform enables merchants to access all their payment and commerce needs within one platform. Merchants can now also add dynamic messaging to deliver relevant, in-context pay later options early in the shopping journey, from the homepage, to product pages, to checkout.

“In today’s challenging retail and economic environment, merchants are looking for trusted ways to help drive average order values and conversion, without taking on additional costs. At the same time, consumers are looking for more flexible and responsible ways to pay, especially online,” said Doug Bland, SVP, Global Credit at PayPal. “With Pay in 4, we’re building on our history as the originator in the buy now, pay later space, coupled with PayPal’s trust and ubiquity, to enable a responsible and flexible way for consumers to shop while providing merchants with a tool that helps drive sales, loyalty and customer choice.”

PayPal said it is focused on enabling choice in how and when customers can pay, including via credit and debit cards, PayPal, Venmo, alternative payment methods, rewards points, PayPal Credit, and other flexible financing options. Along with Pay in 4, PayPal offers several other financing options. PayPal Credit, a reusable line of credit with various promotional offers built in such as six months special financing and Easy Payments, available in the U.S. and U.K., is the most commonly used buy now pay later service. PayPal also offers PayPal Ratenzahlung and Paiement en 4X — installment products in the German and French markets and Pay After Delivery, a buy now, pay later offering in Australia, Canada, France, Germany, Spain, the Netherlands and UK.

Merchants and partners including Aldo Group, Blinds.com, BigCommerce, Swappa and WooCommerce have seen success driving conversions and attracting new customers by making PayPal’s flexible financing options available.

Pay in 4 will be available to consumers on qualifying purchases in early Q4 2020. Merchants and partners can learn more about Pay in 4 and pre-register to get first access here.