Tents & The Long Tail – Spotting ultralight shelters on the AT

by: Martin Vilaboy

Today we call might call them social influencers or expert bloggers, but whatever the moniker this group of participants have always been important to specialty brands and retailers. Before the digital days of tweets and likes, we called them “core enthusiasts,” and now more than ever they are the ones who drive trends and opinions and even specialty product development.

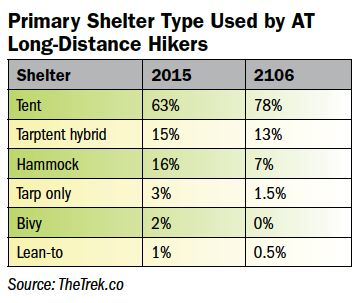

So it’s worth considering the results of a survey by TheTrek.co on tent and shelter usage along the Appalachian Trail. The online community for backpackers and hikers compiled responses from more than 180 thru-hiker and long-distance section hikers who braved the AT in 2016. One would be hard pressed to find a more “core” group of backpacking enthusiasts than those who spend several months, covering as much as 2,100 miles, living predominately under a tent or tarp. For the most part, the findings uncovered by TheTrek.co are somewhat expected, but there are a few surprises worth noting.

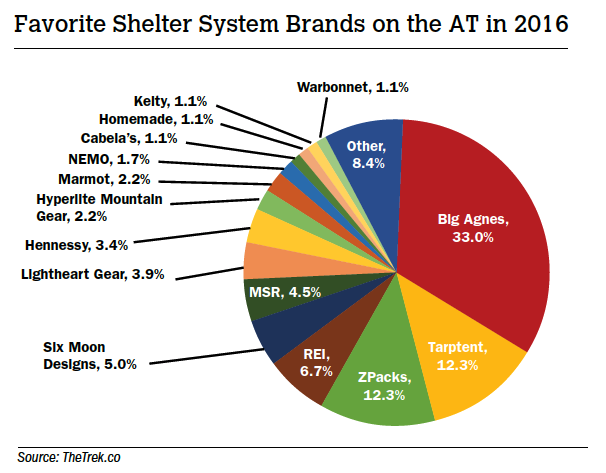

For starters, Big Agnes is crushing it with AT thru- and long-distance hikers. That’s probably not a surprise to some, but even if expected, BA’s performance in the category is nothing short of impressive. A full one-third of the shelters carried by AT distance hikers in 2016 were made by Big Agnes (in the same survey in 2015, 37 percent of AT long-distance hikers slept under a Big Agnes logo), and the brand had three tent models among the top five (Fly Creek UL2, Fly Creek UL1 and Copper Spur UL2).

What’s somewhat surprising, at least to us, is that Big Agnes was the only major brand name with a double-digit percentage of market share. While there are plenty of familiar names among the top 10 or so brands favored by respondents – MSR, Marmot, NEMO, Kelty, among others – more notable are the few smaller names that were able to grab some pretty large chunks of the business. Tied for second, each with 12.3 percent market share, were lesser known ZPacks (top model in the survey was the Duplex) and Tarptent (top model the ProTrail). That placed both companies ahead of the likes of REI and MSR, while names such as Six Moon Designs and Lightheart Gear beat out well-established brands such as NEMO and Marmot. Overall, well more than a third of the tents used by AT long-distance hikers in 2016 came from brands with little name recognition, industry pedigree or marketing budgets.

“We have concentrated our energy on developing clean, simply and functional ultralight gear that meets our customers’ needs,” explained Matt Favero, brand manager and customer experience director at ZPacks. “Flashy ad campaigns, gimmicks and giveaways have never been something that has interested us.”

RELATED: IO Report: Camping’s XYZ

Of course, within the history of outdoor product development, it’s far from unusual for upstarts and innovators to break through and make serious inroads into what is essentially a specialty niche. And the grassroots, feel-good stories behind brands such as ZPacks, Tarptent and Lightheart are familiar tales: Gearhead enthusiasts with math or science backgrounds are not satisfied with what’s available on the market, so they begin to tinker, reinvent the mousetrap, make it into their dream business and, as it often does, the cream rises. But unlike most of their predecessors in the outdoor space, these brands were able to gain traction despite largely foregoing traditional channels of marketing and sales. For the most part, there’s been no big trade show booths and no trade publication push, no significant retail or ecommerce distribution and no manufacturing contacts in Asia. Generally, the go-to-market strategy is word of mouth, orders are taken directly and gear is built by hand right here in the USA.

“Our strategy has always been to rely on word of mouth from our customers and independent reviews,” explains Favero. “This has built a ton of trust with our customer base.”

This small-brand disruption within ultralight shelters would seem to suggest that a handful of larger industry players might somehow be missing the mark with this core group of backpackers. There is, however, something much larger at play here. Likely more important to the overall industry is the realization of changes we’ve been hearing about for some time in how products are brought to market. During the past 10 or so years, we’ve seen lowered minimums for all types of components, while all sorts of technology and machinery have become more and more widely available. At the same time, localized manufacturing, accessible shipping infrastructure and near-free mass communications have increasingly allowed businesses to be run from bedrooms. These smaller, virtual and viral companies, we’ve been warned, often will be more nimble and responsive than their much-larger and loaded-down counterparts, and that seems to be what we are seeing on the AT.

This small-brand disruption within ultralight shelters would seem to suggest that a handful of larger industry players might somehow be missing the mark with this core group of backpackers. There is, however, something much larger at play here. Likely more important to the overall industry is the realization of changes we’ve been hearing about for some time in how products are brought to market. During the past 10 or so years, we’ve seen lowered minimums for all types of components, while all sorts of technology and machinery have become more and more widely available. At the same time, localized manufacturing, accessible shipping infrastructure and near-free mass communications have increasingly allowed businesses to be run from bedrooms. These smaller, virtual and viral companies, we’ve been warned, often will be more nimble and responsive than their much-larger and loaded-down counterparts, and that seems to be what we are seeing on the AT.

“Our website, customer service department, manufacturing, design and shipping is all handled under the same roof,” says Favero. “This allows for quick and seamless changes to products and implementation of new designs.”

Lightheart Gear, for instance, says it will ship out shelters within 48 hours of ordering, while ZPacks shelters are “made to order” and typically ship within a week. In many cases, these smaller brands can handle some modification and customization of existing designs and often handle repairs. And according to Tarptent founder Henry Shires, one of the biggest advantages of selling directly to consumers is that it allows for more direct customer feedback and design collaboration.

Indeed, what The Trek.co findings show us is that the crack of the long tail is being heard within the ultralight shelter market. And keep in mind, these are not specialty socks or T-shirts. Backpacking gear is a complicated business with lots of components and suppliers, specialized fabrics, testing and assembly. It can be challenging to scale for even well-funded operations.

At this point, we are not seeing similar disruption in the sleeping bags, footwear or backpacks used on the AT, according to similar surveys performed by TheTrek.co. But if it can happen in shelters, it certainly can in these categories, as well. Welcome to life on the long tail.

This article is sponsored by: Kovea

VIEW ARTICLE

SUBCRIBE TO MAGAZINE

About Inside Outdoor Magazine:

We know outdoor executives have access to plenty of instantaneous information. But one thing decision makers overwhelmingly tell us they can’t get enough of is thoroughly researched and highly scrutinized news and analysis that can be applied directly to improving day-to-day operations.

Having surpassed more than a decade in the industry, Inside Outdoor Magazine’s staff of seasoned outdoor journalists represent years of experience in specialty retail, product manufacturing, business analysis and living the outdoor lifestyle. We believe this mix of backgrounds is a key component to complementing your marketing message with the business modeling, cost-margin analysis, trend forecasting and quantified operational advice that’s already proven to capture loyalty and engage readers, and studies show that reader engagement with media and advertising can drive sales.

Your customers would need to expend significant time and money to amass the information and advice, in addition to, the requisite industry movements, trends and product innovations—that we deliver straight to their mailboxes, for free, all year round.