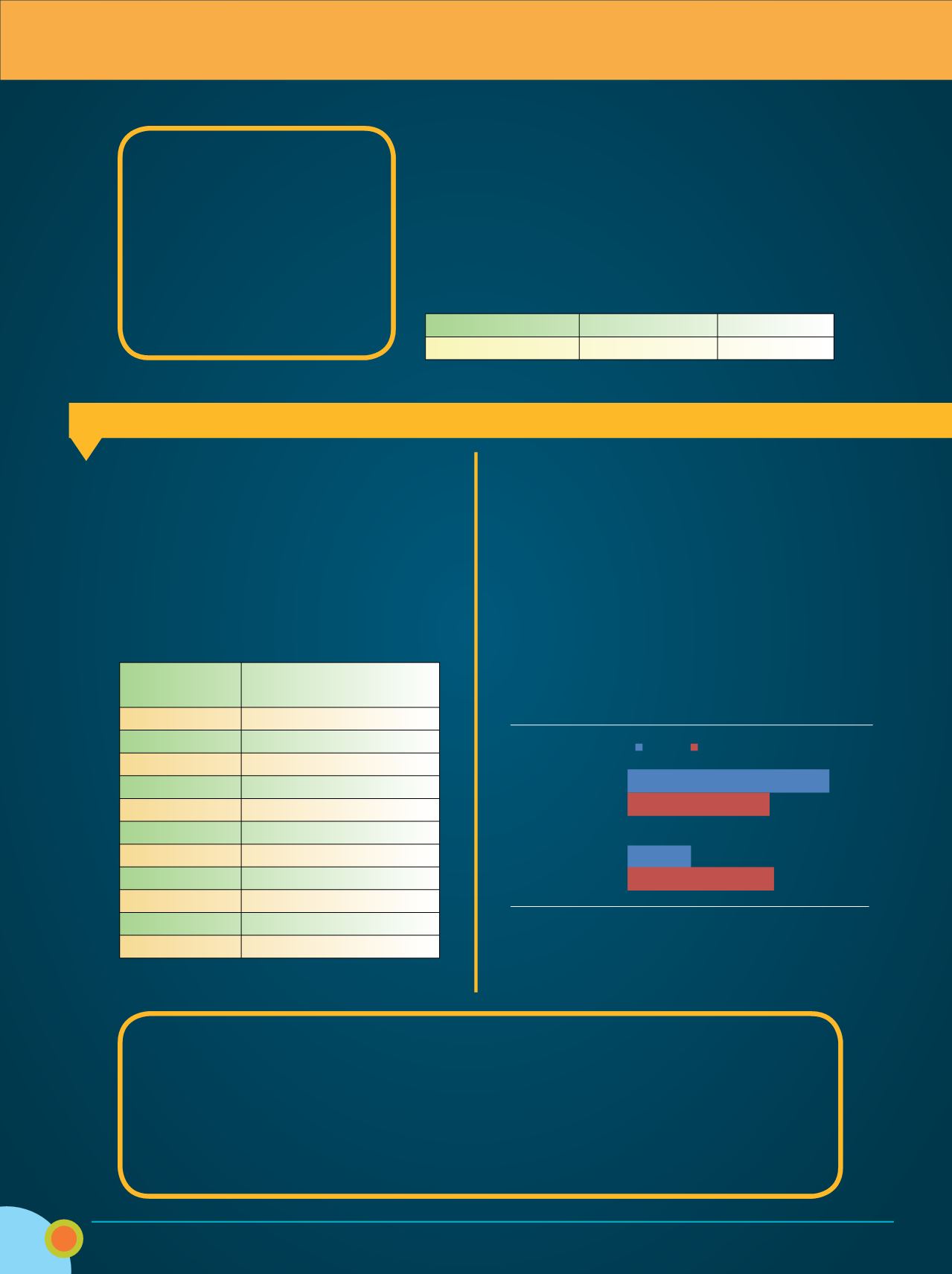

DATA POINT

More Mortar

Given the recent declines in foot traffic, and the steady

increases in online sales, one would assume retailers

would see more headroom for growth in the digital realm.

Retailers surveyed by RSR Research, however, show that

physical stores are actually gaining traction as a growth

driver, particularly when it comes to opening stores in new

geographic areas.

75%

Climb Up

A possible sign the growth in climbing gyms are helping grow the

overall market, key climbing categories experienced solid growth in

the first quarter of 2016, according The NPD Group figures, with

climbing hardware increasing in dollar volume by 12 percent, fueled

specifically by cams and quickdraws. Climbing shoe brands Scarpa,

La Sportiva, Evolv, Five Ten and Tenaya all contributed to the overall

category growth of 22 percent, says NPD.

77%

Percent of women in the MercuryCSC

“Adventurist panel” who say they

prefer that outdoor brands not mar-

ket to women and men differently.

First Quarter Climbing Dollar Sales

Q1 2015

Q1 2016

% Change

$35.7M

$40.4M

13%

Source: The NPD Group

Run Down?

The number of U.S. marathon finishers de-

clined for the first time in many years, with the

exception of 2012*, when the New York City

Marathon was cancelled. The decline in 2015

follows several years of impressive growth, show

Running USA figures, a pace admittedly hard to

maintain. But the steep drop in 2015 is cause to

keep an eye on future numbers.

Year

Estimated U.S.

Marathon Finishers

1976

25,000

1980

143,000

1990

224,000

2000

353,000

2005

395,000

2010

507,000

2011

518,000

2012

487,000*

2013

541,000

2014

550,600

2015

509,000

Source: Running USA

Growth Drivers: Stores vs. Digital Channels:

% Agreeing

Source: RSR Research

41%

Source: TimeTrade

If you could schedule on in-store appointment

(from any device) with a store associate

at a time that is most convenient for you,

would you?

65%

35%

54%

72%

66%

46%

28%

34%

No

Yes

Gen Z

Millennials

Gen X

Baby Boomers

More physical stores

in new geographies

Emphasize degital,

de-emphasize stores

77%

54%

24%

56%

2016 2015

Amazon Robots Installed inWarehouses

Percent of consumers who report their biggest challenge

when shopping for outdoor gear is not being able to find an

available store associate when needed, according to Sarah

Wallace, principal market analyst for TimeTrade.

Inside

Outdoor

|

Summer

2016

10