Direct

Feed

www.insideoutdoor.comFloorSpace

BackOffice

FloorSpace

BackOffice

Outdoor

Textile

Green

Glossary

Retail

Report

Outdoor

Textile

Green

Glossary

Retail

Report

www.insideoutdoor.comProducts

Section

www.insideoutdoor.comProducts

Section

Inside

Outdoor

|

Spring

2016

52

“If the

customer

isn’t happy,

they probably aren’t comingback.”

Let’s be honest, who really

likes returns? As retailers, you

are in the business of selling

merchandise, not taking it back,

right? After all, returns take

time and generally mean the

customer had a negative experi-

ence with the merchandise or

simply had a change of heart,

and now their problem is soon

going to become your problem.

Full disclosure here, that used

to be my mindset. I dreaded see-

ing our bags coming back into

the store. My hunch is that a lot

of you may feel the same way.

During the years, returns

of retail sales have steadily in-

creased, with 9 percent of retail

sales being returned, according

to the Kurt Salmon consulting

firm. The latest figures available

suggest that returns in 2014

hit $284 billion, up 6.2 percent

from the previous year. Some

attribute this increase to online

shopping since one-third of on-

line purchases come back.

I decided to poll a cross-

section of retailers that I consult

with to find out what their return

policies are. I wasn’t terribly

surprised with what I learned.

It appears that the smaller the

volume a store does, the stricter

their return policy is. The general

consensus being that smaller

retailers feel they simply can’t

afford a more liberal policy, thus

opting for store credits in lieu of

cash refunds and a tighter win-

dow in which returns are accept-

ed. Larger volume operations,

on the other hand, approach

Is Your Return Policy Hurting

Your Business?

By Ritchle

Sayner

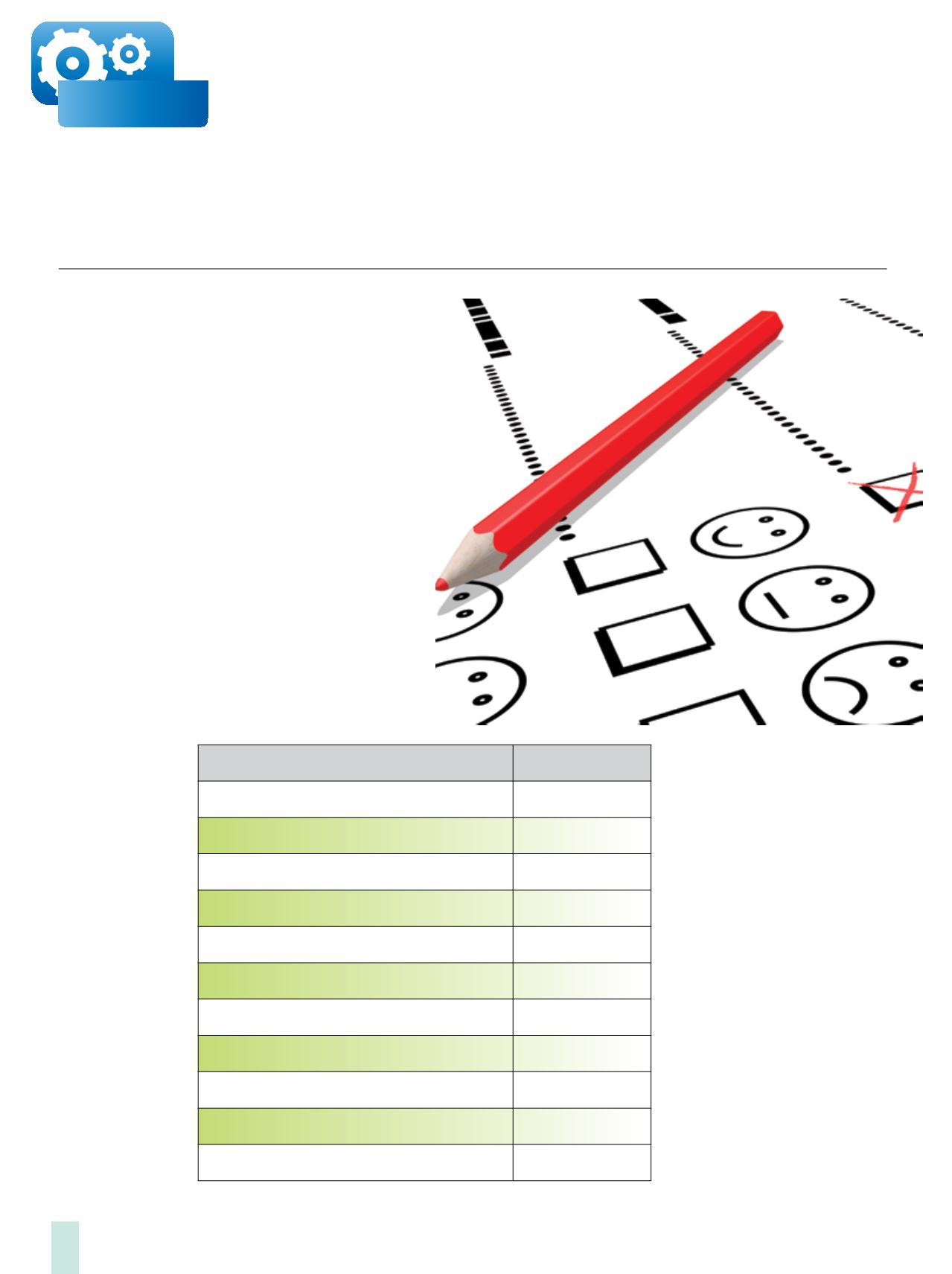

Leading Cause of Retail Returns

Reason

Global $$

1. Defective/poor quality

$162 billion

2. Bought wrong item

$99.3 billion

3. Buyer’s remorse

$88.7 billion

4. Better price elsewhere

$83.4 billion

5. Gift returns

$64.1 billion

6. Wrong sizing on item

$62.4 billion

7. Return fraud

$28.2 billion

8. Didn’t match online description

$6.1 billion

9. Late delivery of items

$4.6 billion

10. All other reasons

$43.8 billion

Total

$642.6 billion

Source: IHL Group