Data

Points

www.insideoutdoor.comR

E

P

M

O

V

E

S

A

N

D

N

E

W

S

www.insideoutdoor.comR

E

P

M

O

V

E

S

A

N

D

N

E

W

S

Data

Points

www.insideoutdoor.com www.insideoutdoor.comConnect But Not Connected

Experience seekers are more interested in stay-

ing connected while traveling than while participat-

ing in outdoor activities, show surveys by Mercury

CSC. However, they report being very interested in

gadgets designed to charge or power other devices

while in the outdoors. “This points to a mismatch

between intention and re

ality among outdoor recre-ation participants,” says t

he research and brandingagency. “They are drawn to the allure of power-

generating gadgets but are not interested in being

connected through the use of those gadgets.”

Worldwide Wearable Device Shipment, (Units in Millions)

Source: International Data Corporation

Age Distribution at The Top Social Networks

Source: comScore

Source: Boston Retail Partners, NR

Source: Invoca

Exploration

Consider

13%

44%

43%

42%

23%

Monitoring Single

Platform Trend

and Gathering

Information for

Education

Actively

Discussing

Viability of

Single Platf

Aproach, b

Formal Pla

Budget in

Key Initiatives Addres

Source: Boston Retail Group, NRF

Percentage of U.S

in Sharing Transac

Source: PricewaterhouseCoop

0%

5%

10%

15%

20%25%

30%

25%

Quickly

Respond to

Consumer

Demands

Entertainment

and Media

ages 65

and older

Autom

and

Transpor

% of respondents

than a website can answer

To accomplish something

that can’t be done through

the business’s web ite

To get more accurate

information than can be

found from other sources

It’s convenient

Snapchat

Vine

Tumblr

Google+

45%

26%

13% 10% 6% 1%

28%

23%

17% 15% 10% 7%

28%

25%

18% 13% 11% 6%

23%

26%

19% 15% 12% 4%

19%

22%

21%

18% 13% 7%

16%

25%

22%

18% 13% 7%

16%

22%

19%

18% 15% 10%

15% 26%21%

17% 15% 7%

14% 21%

22%

18% 16% 9%

18-24

25-34

35-44

45-54

55-64

65+

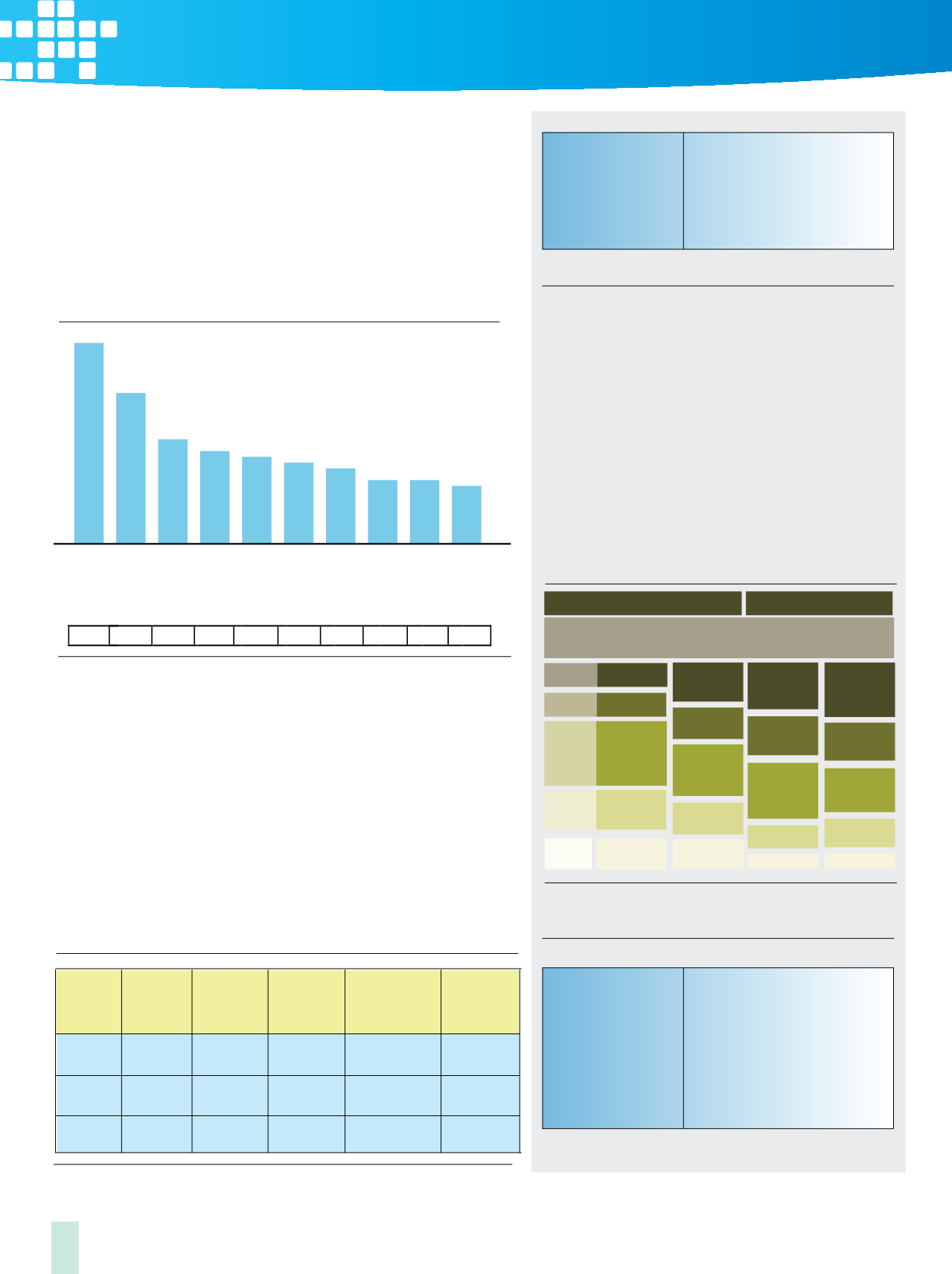

Product

Category

2014

Shipments

2015

Shipments

2019

Shipments

2015

Year-Over-Year

Growth

2014-2019

CAGR

Basic

Wearables 22.1

4.2

26.4

39

33.1

72.1

66.3

89.4

155.7

76%

683%

173.3%

24.5%

84.1%

42.6%

Smart

Wearables

All

Wearables

9%

8

Age Breakdown of Provi

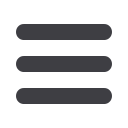

Backpacking’s Back?

Too often considered a relic of times past, overnight backpacking

appears to be making a resurgence, ranking among the top-growing

outdoor activities for 2014, according to Outdoor Industry Associa-

tion figures, with 11% growth. Backpacking overnight also experi-

en

ced healthy three-year growth, at 12.8%. Most impressive of all,

am

ong the top-growing activities listed, backpacking has by far the

largest base of users to build upon.

A Wearable World

Basic wearables that do not run third-party apps have driven the

market so far, which International Data Data Corp. estimates will hit 72.1

million units shipped in 2015, up from the 26.4 million units shipped in

2014. “Vendors like Fitbit and Xiaomi have helped propel the market with

their sub-$100 bands,” said Jitesh Ubrani, IDC senior research analyst.

Ubrani, however, expects devices capable of running third party apps to

take the lead in 2016. “Smart wearables like the Apple Watch and Mico-

soft’s Hololens are indicative of an upcoming change in computing, and

the transition from basic to smart wearables opens up a slew of opportu-

nities for vendors, app developers and accessory makers.”

Top Outdoor Activities for Growth, 2014

[Number of participants (000) at bottom]

Sou

rce: OIAPhases of Journey Toward U

Source: Boston Retail Partners, NRF

Source: Mercury CSC

Why Buyers Choose to Call

Source: Invoca

Exploration

Consideration

13%

59%

57%

54%

44%

43%

42%

23%

Monitoring Single

Platform Trend

and Gathering

Information for

Education

Actively

Discussing

Viability of

Single Platform

Aproach, but no

Form l Plan or

Budget in Place

Stand Up

Paddling

Downhill

Telemarketing

Boardsailing

/Windsurfing

Snowshoeing

Kayak Fishing

Freestyle

Skiing

Cross-country

Skiing

Backpacking

Trail Running

White Water

Kayaking

38%

26%

18%

16% 15% 14% 13%

11% 11% 10%

2,751

2,188

1,562

3,501

2,074

4,564

3,820

10,101

7,531

2,351

To quickly get an answer/

accomplish my goal

To talk to a real person

I have mor questions or

need more information

than a website can answer

To accomplish something

that can’t be done through

the business’s website

To get more accurate

information than can be

found from other sources

It’s convenient

WHILE OUTDOORS

17%

30%

22%

1 %

35%14%

22%

17%

16%

15%

Extremely

Interested

A gadget to

help me stay

connected

A gadget to

help my other

gadgets stay

powered

Very

Interested

ModeratelyInterested

Slightly

Interested

Not at all

Interested

r Growth, 2014

at bottom]

Phases of Journey Toward Unified Commerce Platform

Source: Mercury CSC

to Call

Consideration

Strategy

Execution

Reali

59%

57%

54%

44%

23%

36%

13%

9%

Creating a

Implementing

a Strategy -

Business and

Technical - to

Oper

Singl

and

Benef

Gaug

Inves

Kayak Fishing

Freestyle

Skiing

Cross-country

Skiing

Backpacking

Trail Running

White Water

Kayaking

6% 15% 14% 13%

11% 11% 10%

,501

2,074

4,564

3,820

10,101

7,531

2,351

WHILE OUTDOORS

WHILE TRAVELING

30%

26%

21%

23%

32%

17%

30%

22%

12%

35%

14%

25%

22%

17%

16%

15%

13%

6%

16%

8

Extremely

Interested

A gadget to

help me stay

connected

A gadget to

help my other

gadgets stay

powered

A gadget to

help my other

gadgets stay

powered

A gadget to

help me stay

connected

Very

Interested

Moderately

Interested

Slightly

Interested

Not at all

Interested

32

Percentage of women with childre

who ride a bike once a year,

compared to 19% of women without

children, according to surveys by

PeopleForBike.org.44

Billions of dollars lost last year

by retailers to theft and fraud,

according to the National Retail

Federation and University of

Florida National Retail Security

Survey. Retailers say inventory

shrink averaged 1.38 percent of

retail sales.

Inside

Outdoor

|

Summer

2015

10