2015, 37 percent of AT long-distance

hikers slept under a Big Agnes logo),

and the brand had three tent models

among the top five (Fly Creek UL2,

Fly Creek UL1 and Copper Spur UL2).

What’s somewhat surprising, at

least to us, is that Big Agnes was

the only major brand name with a

double-digit percentage of market

share. While there are plenty of fa-

miliar names among the top 10 or

so brands favored by respondents –

MSR, Marmot, NEMO, Kelty, among

others – more notable are the few

smaller names that were able to grab

some pretty large chunks of the busi-

ness. Tied for second, each with 12.3

percent market share, were lesser-

known ZPacks (top model in the sur-

vey was the Duplex) and Tarptent (top

model the ProTrail). That placed both

companies ahead of the likes of REI

and MSR, while names such as Six

Moon Designs and Lightheart Gear

beat out well-established brands such

as NEMO and Marmot. Overall, well

more than a third of the tents used

by AT long-distance hikers in 2016

came from brands with little name

recognition, industry pedigree or

marketing budgets.

“We have concentrated our en-

ergy on developing clean, simply and

functional ultralight gear that meets

our customers’ needs,” explained

Matt Favero, brand manager and cus-

tomer experience director at ZPacks.

“Flashy ad campaigns, gimmicks and

giveaways have never been something

that has interested us.”

Of course, within the history of

outdoor product development, it’s

far from unusual for upstarts and in-

novators to break through and make

serious inroads into what is essentially

a specialty niche. And the grassroots,

feel-good stories behind brands such

as ZPacks, Tarptent and Lightheart are

familiar tales: Gearhead enthusiasts

with math or science backgrounds are

not satisfied with what’s available on

the market, so they begin to tinker,

reinvent the mousetrap, make it into

their dream business and, as it often

does, the cream rises. But unlike most

of their predecessors in the outdoor

space, these brands were able to

gain traction despite largely forego-

ing traditional channels of marketing

and sales. For the most part, there’s

been no big trade show booths and no

trade publication push, no significant

retail or ecommerce distribution and

no manufacturing contacts in Asia.

Generally, the go-to-market strategy

is word of mouth, orders are taken

directly and gear is built by hand right

here in the USA.

“Our strategy has always been

to rely on word of mouth from our

customers and independent reviews,”

explains Favero. “This has built a ton of

trust with our customer base.”

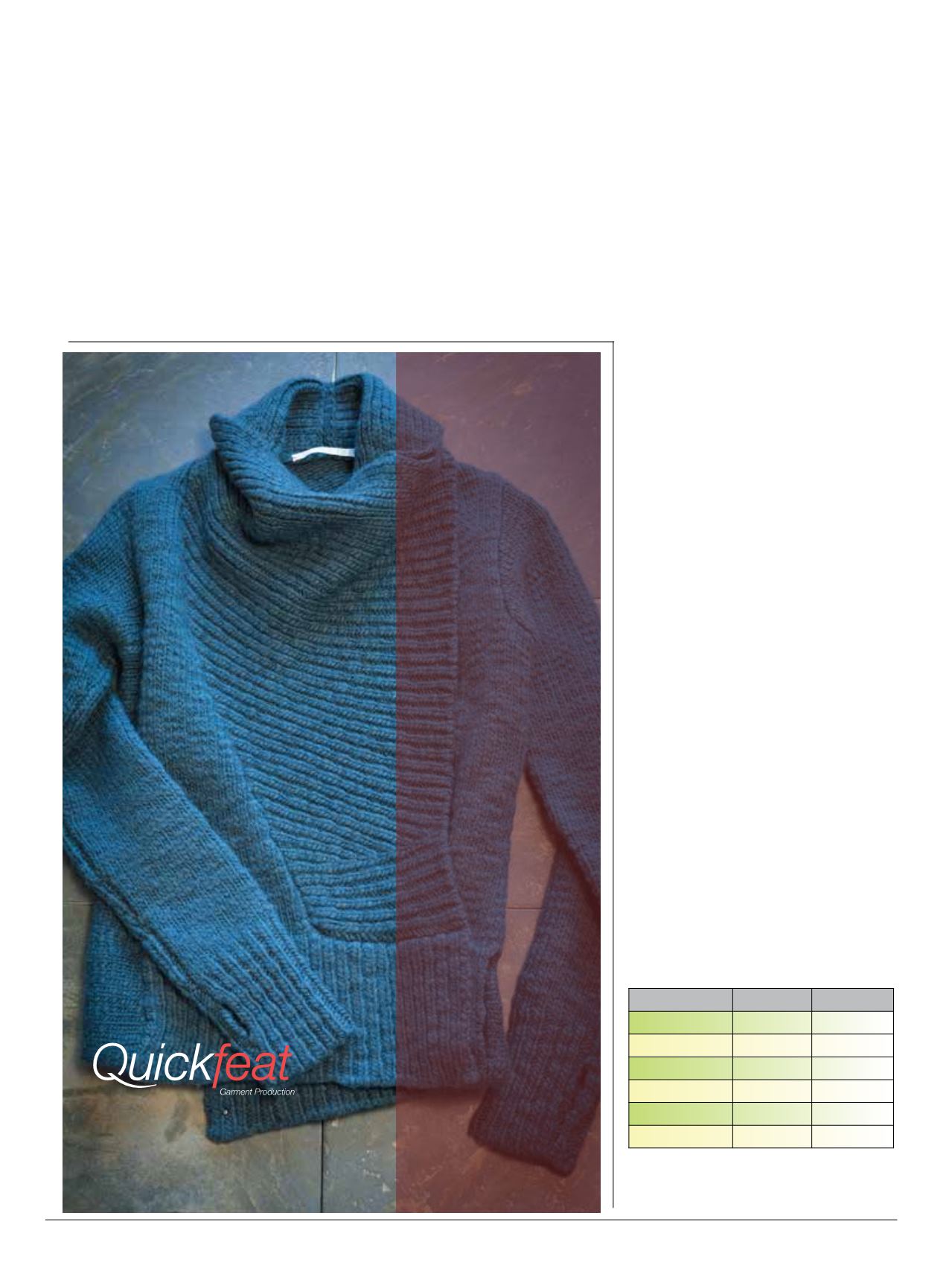

Primary Shelter Type Used by AT

Long-Distance Hikers

Shelter

2015

2106

Tent

63%

78%

Tarptent hybrid

15%

13%

Hammock

16%

7%

Tarp only

3%

1.5%

Bivy

2%

0%

Lean-to

1%

0.5%

Source:

TheTrek.coAPPAREL

SOURCING &

PRODUCTION

INDIA

VIETNAM

CHINA

HONG KONG

USA

Quickfeat

produces

sweaters, knits, wovens

outerwear, activewear,

leather, swim and

organics.

Our Services

- Fabric Sourcing

- Trim Sourcing

- Garment Development

- Factory Sourcing

- Production

- Quality Control

- Packing & Logistics

541 350 1615

Marketing O ice

Bend, Oregon USA

info@quickfeat.com|

www.quickfeat.comInside

Outdoor

|

Spring

2017

26