that tailor their promotions and customer

communications accordingly stand

the best chance for marketing victory.

Fortunately, data and analysis from prior

holiday rushes can be used to gain a

better understanding of what is likely to

work during the upcoming weeks.

Coming as little surprise, mobile

matters more and more every year.

According to Custora’s E-commerce

Pulse of the 2015 holiday season,

nearly a third (30.4 percent) of online

purchases during holiday 2015 were

made on mobile devices (smartphone

and tablet), up from about a quarter

or less during the prior 12 months,

including the fourth quarter of 2014.

On Black Friday alone, which Custora

re-dubs as “Mobile Friday,” mobile

devices accounted for 36.1 percent

of online sales, up from 30 percent

in 2014. Analysis by IBM’s Watson of

millions of online sessions and trans-

actions on Black Friday likewise found

mobile accounting for 36.2 percent of

Black Friday online sales, an increase

of nearly 30 percent over Watson’s

findings the prior year.

And it’s not just purchasing. Accord-

ing to Watson, Black Friday mobile traf-

fic exceeded desktop traffic, accounting

for 57.2 percent of all online traffic, an

increase of 15.2 percent over 2014.

Smartphones alone accounted for

44.7 percent of all online traffic, three

and a half times that of tablets at 12.5

percent. Smartphone also surpassed

tablets in sales, driving 20.6 percent of

online sales (up nearly 75 percent over

2014) versus tablets at 15.5 percent.

The trend toward mobile shopping

was even more pronounced – albeit at

a significantly less dollar volume – on

Thanksgiving Day, when orders on

phones and tablets constituted about

40 percent of all e-commerce transac-

tions. That might seem intuitive, since

would-be shoppers might be reluctant

to leave a house full of family members

or hole up in the home office to shop,

yet they have ample time to thumb

through their phones while on the

couch watching T-Day football or re-

covering from a tryptophan overdose.

Of course, retailers that have yet to

invest in advanced mobile capabilities

or mobile payment options are unlikely

to deploy these m-commerce options

by late November. But no worries, as

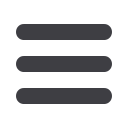

Black Friday Performance by Device

Source: IBM Watson

Percent Share of E-commerce

Orders by Channel

Shoe

Shoe

Mobile’s Percent of Black Fridays Online Sales

and Traffic

Source: IBM Watson

70%

60%

50%

40%

30%

20%

10%

0%

% of Traffic

% of Sales

Conversion

Rate

Bounce

Rate

Average Page

Views

Average Order

Value

3.2% 5.6%

9.8%

14.3%

24.0%

39.7%

49.6%

36.2%

21.8%

2010

2011

2012

2013

2014

2015

Mobile % of Sales

Mobile % of Traffic

20.6%

15.5%

63.8%

2.4%

5.2%

6.3%

34.4%

30.5%

28.2%

7.5

8.6

10.3

$111.66

$136.42

$134.06

12.5%

44.7%

42.7%

Smartphone

Tablet

Desktop

21.5

17.7

20

12.2

1.8

1.2

19.4

6.3

WSER

Pearl

Izumi

Salomon

Montrail

Altra

5.7%

8.8%

9.3%

16.5%

16.3%

27.9%

57.2%

GG1000-1A3

Specialized gear for relentlessly challenging extreme limits

Mud Resistant Structure/Compass & Thermometer

©2016 CASIO AMERICA, INC.

C

M

Y

CM

MY

CY

CMY

K

CAS16-4587 GS MUDMASTER PRINT AD FRED MEYER JEWELERS FNL.pdf 1 7/21/16 1:09 PM

Fall

2016

|

Inside

Outdoor

31