show Yesmail figures, garner-

ing their best open rates in

the days preceding and just

following December 25. Gen-

eral holiday emails, or those

that reference the holiday or

winter season without specific

mention of a holiday, have

become increasingly popular

among retailers and brands

yet elicit lukewarm reactions

from consumers. They tend

to generate open rates similar

to those of base communica-

tions but lower than specifi-

cally themed emails.

Overall, as marketers get

closer to the end of the year,

their email volumes tend to

increase significantly week-over-week.

Yesmail suggests avoiding such a late

season ramp up in favor of a more con-

sistent and level approach, since open

rates tend to decrease as the volume in-

creases and holiday marketing “burnout”

sets in among recipients.

Email open rates also provide

insight into the type of content that

will resonate with shoppers during the

holiday rush. And more than anything,

those shoppers are looking for ways

to deal with the time crunch and stress

typically associated with the season.

For instance, when Deloitte asked

holiday shoppers to name desirable

attributes for sales associates, 63 per-

cent of respondents said “help

me check out quickly.”

That overarching attitude

likely explains why emails

with vague subject lines such

as “Shop Online Specials” or

“10 Percent off Cyber Monday

Purchases” underperformed

while emails that focused on

a sense of urgency or a fast-

approaching deadline tended

to be higher performing,

shows Yesmail data.

“Marketers can spur action

by reminding users of an im-

pending deadline for a sale or

delivery guarantee,” say Yes-

mail researchers. “However,

they should avoid overuse or

subscribers may not view them

as genuine or worthwhile.”

Ultimately, whether it’s

a subject line, viral video

campaign or Instagram post, marketers

would be wise to focus on providing

shoppers with “holiday help,” rather

than incessantly pounding them about

discounts and savings. (It’s doubtful

most specialty businesses are inter-

ested in chasing discount hunters,

anyway.) Help can come in the form of

holiday guides and how-to articles, gift

suggestions, deadline reminders and

checklists. In other words, a message

built around “gift ideas for grandma,”

is much more compelling than “20%

discounts storewide through Monday.”

A video campaign, for instance, could

highlight a shopper’s journey through a

store and all the gift ideas she discov-

ered (with help from a staff member,

of course), or a product video

can demonstrate the fun a

gift recipient can have playing

with their new gizmo out of

the box.

Surveys also suggest that

shoppers are looking to save

time during the holidays almost

as much as they are looking

to save money. That’s largely

why the ability to check in-store

availability of a product online

is widely desired by holiday

shoppers, although it remains

a somewhat unmet demand.

Emails or posts about the re-

stocking of popular items carry

a similar appeal.

Likewise, special extended

hours for VIP customers, such as an

hour before opening or after closing,

can be seen as a way to alleviate the

holiday time-crunch, as can shopping

appointments with expert staff mem-

bers, who can be armed beforehand

with customer profiles or gift recipient

lists. Ultimately, anything that can be

done just to get people to walk into

the store will likely prove beneficial for

the retailer. Among consumers who at-

tended an in-store holiday event, such

as a fundraiser or movie screening,

nearly 60 percent also make a pur-

chase. And overall, holiday shoppers

reported to making 43 percent of their

purchase decisions during the shop-

ping experience, according to

Prosper Insight figures.

And whatever you do, don’t

forget procrastinators when

devising inventory and pro-

motional strategies. Certainly,

ever year a good percentage

of shoppers wait until the pro-

verbial last minute. As much

as 40 percent of 2015 holiday

season sales took place in the

last 10 days before Christmas,

according to analysts at Retail

TouchPoints. With Christmas

Eve falling on a Saturday this

year, that percentage could

be even bigger in 2016, as we

expect Christmas weekend to

be crazy-busy this year.

So, have your holiday gift

suggestions ready. Here’s a few

we came across to help spark

some yuletide brainstorming.

Social Media Platform to which US Social

M dia Users Are Most Likely to Turn for

Holiday Shopping Ideas/Inspiration

Source: GO/Digital

rand - All Finishers

Shoe Brand - All Finishers

Shoe Brand - Sub 24 Hour Finish

rand - Sub 24 Hour Finish

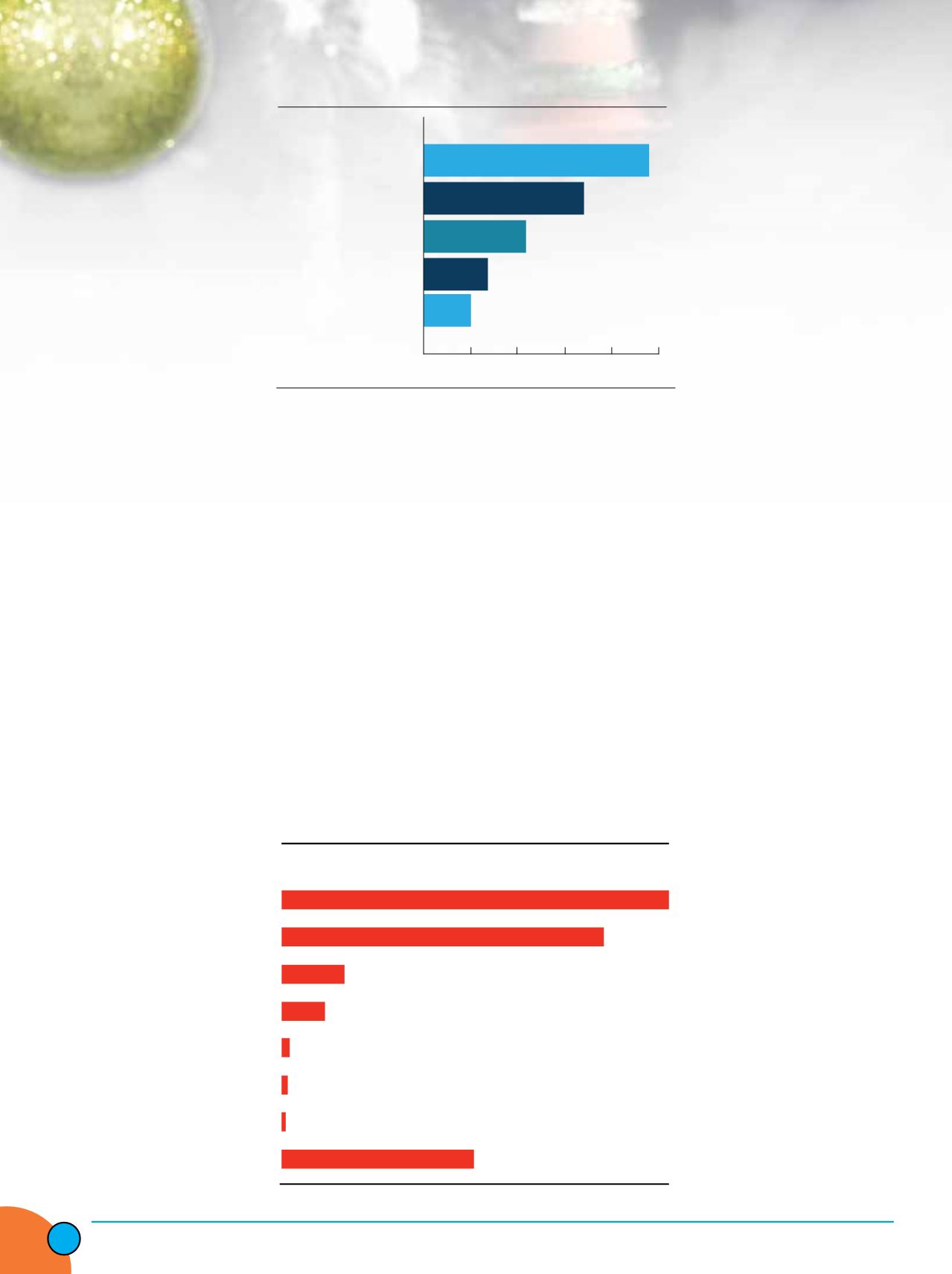

Issues that Hindered Holiday 2015 Sales

Source: National Retail Federation

Poor Inventory Control

Promotional Issues

Poor Planning

Not Enough Advertising

Merchandising Mistakes

0% 5% 10% 15% 20% 25%

Fut

% of respondents

37.9%

31.6%

4.1%

4.3%

0.7%

0.5%

0.2%

18.8%

2015

2016

Snapchat

Periscope

Other

hoe Brand Survey

Others

Oka

Altra

Brooks

Pearl Izumi

Nike

Salomon

Brooks

Hoka

26%

17%

9.4%

26.4%

6.1%

7.6%

7.6%

34.5%

19.6%

11

11

67

72

47

26 21

21

17

73

38

32

18

17

15%

10%

5%

0%

Percent

% of r

Source

US

an

Source

% of respondents

Product Cat

Prefer to Pu

Food

Health & beau

Shoes

Mobile phone

Jewelry

Clothing

Computers

Games

Social Media Platform to which US Social

Media Users Are Most Likely to Turn for

Holiday Shopping Ideas/Inspiration

Source: GO/Digital

Issues that Hindered Holiday 2015 Sales

Source: National Retail Federation

Poor Inventory Control

Promotio al Issues

Poor Planning

Not Enough Advertising

Merchandising Mistakes

0% 5% 10% 15 20% 25%

Fut

% of respondents

37.9%

31.6%

4.1%

4.3%

0.7%

0.5%

0.2%

18.8%

Snapchat

Periscope

Other

15%

10%

5%

0%

Percen

% of

Sourc

US

an

Sourc

% of respondents

Product Ca

Prefer to Pu

Food

Inside

Outdoor

|

Fall

2016

34