Prosper principal analysts Pam Good-

fellow suggests, retailers looking to

prioritize for holiday 2016 may want to

emphasize promotional programs over

mobile payments.

“Our research suggests that con-

sumers in general just aren’t completely

comfortable with the idea of mobile pay-

ment yet,” said Goodfellow. “However,

expect consumers to take advantage of

mobile offerings that provide them with

perks: an exclusive deal, special sales

and the ever-popular coupon code. I

think consumers may also rely on in-

ventory tracking capabilities, especially

for any in-demand items.”

In other words, before adding new

capabilities, focus on site performance

and mobile compatibility. Data from

DirectBuy reveals that smartphone and

tablet users are five times more likely

to abandon a task if the site isn’t mobile

optimized. Retailers need to make sure

the on-the-go, smaller screens are being

considered, at least to some degree,

across all digital campaigns, coupons

and customer communications, including

any social media efforts that ultimately

link back to an internal Web site.

Not Dad’s Email

Mobile’s largest impact on retail holi-

day promotions could stem from its role

in accessing emails. Nowadays, more

emails are opened on smartphones than

on desktops, and make no mistake, as

the Grand Daddy of digital marketing,

email remains a top means of retail cus-

tomer communication and acquisition.

That includes interactions with younger

cohorts. Per a study by marketing

technology provider Adestra, nearly 68

percent of teens and 73 percent of mil-

lennials said they prefer to receive com-

munications from a business via email,

while more than half of each group says

they rely on email to buy things online.

Not surprisingly, those figures are similar

to the number of Gen Xers and Baby

Boomers who say the same.

In turn, email marketing’s role within

holiday promotions cannot be underes-

timated. According to Custora figures,

emails to a house list led to 20 percent

of online orders during Holiday 2015,

making it the second largest channel

for sales after organic (free) search

(21.5 percent). Its influence peaks

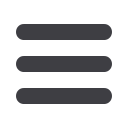

Source: IBM Watson

Percent Share of E-commerce

Orders by Channel

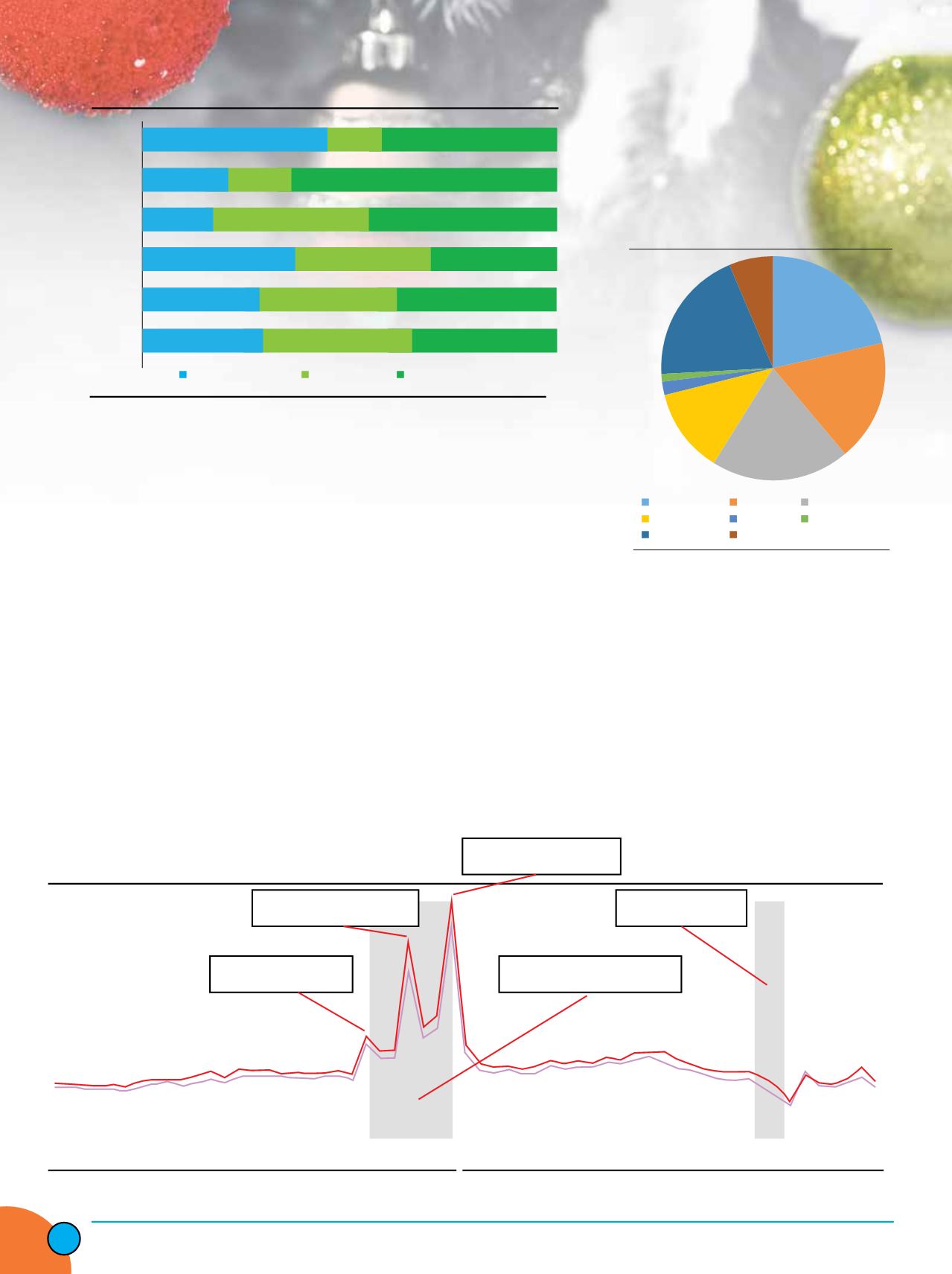

E-Commerce Revenue by Day

Source: Custora

Smartphone

Tablet

21.5

17.7

20

12.2

1.8

1.2

19.4

6.3

Organic search Paid search Email

Affiliate

Social

Display ads

online

Direct

Other

NOV

02

03

05

07

09

11

13

15

17

19

21

23

04 06 08 10 12

14 16 18

20 22

BLACK FRIDAY

TURKEY DAY

+10.7%

2015

2014

Soci

Medi

Holi

Source: G

Black Friday Performance by Device

Source: IBM Watson

Percent Share of E-commerce

Orders by Channel

E-Commerce Revenue by Day

Shoe Brand - All Finishers

Shoe Br

Shoe Bra

Shoe Brand - Sub 24 Hour Finish

Source: Custora

% of Traffic

% of Sales

Conversion

Rate

Bounce

Rate

Average Page

Views

Average Order

Value

20.6%

15.5%

63.8%

2.4%

5.2%

6.3%

34.4%

30.5%

28.2%

7.5

8.6

10.3

$111.66

$136.42

$134.06

12.5%

44.7%

42.7%

Smartphone

Tablet

Desktop

21.5

17.7

20

12.2

1.8

1.2

19.4

6.3

Organic search Paid search Email

Affiliate

Social

Display ads

online

Direct

Other

CYBER MONDAY

+12.5%

LAST MIN. RUSH

BLACK FRIDAY

+17.4%

Facebo

% of re

0.7%

0.5%

0.2%

2015

Pintere

Instagr

Linkedi

Snapch

Perisco

Other

WSER Shoe Brand Survey

Source: WSER Runner Survey

Pearl

Izumi

Salomon

Montrail

Altra

Others

Pearl Izumi

Nike

Salomon

New

Balance

Brooks

Nike

Salomon

Montrail

Others

Brooks

New Balance

Salomon

Brooks

Hoka

Altra

Hoka

Nike

5.7%

8.8%

9.3%

16.5%

8.3%

23.3%

26.4%

6.1%

7.6%

7.6%

4.9%

5.8%

9.7%

11.7%

8.3%

8.3%

11.1%

12.5%

34.5%

19.6%

34.7%

16.7%

11

11

67

1

25

12

9

8

6

6

6

38

32

18

17

Source: GO/Dig tal

Source: IBM Watson

Percent Share of E-commerce

Orders by Channel

E-Commerce Revenue by Day

Shoe Brand - All Finishers

Shoe Brand - A

Shoe Brand - Su

Shoe Brand - Sub 24 Hour Finish

Source: Custora

Average Page

Views

Average Order

Value

7.5

8.6

10.3

$111.66

$136.42

$134.06

Smartphone

Tablet

Desktop

21.5

17.7

20

12.2

1.8

1.2

19.4

6.3

Organic search Paid search Email

Affiliate

Social

Display ads

online

Direct

Other

NOV

02

03

05

07

09

11

13

15

17

19

21

23

25

27

29

01

03

05

07

09

11

13

15

17

19

21

23

25

27

29

04 06 08 10 12

14 16 18

20 22 24 26 28 30 02 04 06 08 10

12

14 16 18 20

22 24 26 28 30

DEC

CYBER MONDAY

+12.5%

LAST MIN. RUSH

“CYBER WEEK”

NOV 24-30

BLACK FRIDAY

+17.4%

TURKEY DAY

+10.7%

2015

2014

0.7%

0.5%

0.2%

2015

2016

Snapchat

Periscope

Other

WSER Shoe Brand Survey

Source: WSER Runner Survey

Pearl

Izumi

Salomon

Montrail

Altra

Others

Pearl Izumi

Nike

Salomon

New

Balance

Brooks

Nike

Salomon

Montrail

Others

Brooks

New Balance

Salomon

Brooks

Hoka

Altra

Hoka

Nike

5.7%

8.8%

9.3%

16.5%

8.3%

23.3%

26.4%

6.1%

7.6%

7.6%

4.9%

5.8%

9.7%

11.7%

8.3%

8.3%

11.1%

12.5%

34.5%

19.6%

34.7%

16.7%

11

11

67

26 21

21

17

73

24

12

10

6

5

25

12

9

8

6

6

6

38

32

18

17

Inside

Outdoor

|

Fall

2016

32