ways in which millennial priorities and

realities are unique to previous genera-

tions. All generations are unique, and

Generation Z will likely bring entirely new

characteristics to marketers’ attention.

Rather, it’s an acknowledgement of how

younger generations are almost always

viewed by their elders as “different,” if

not “weird and demented.” So we have

to wonder how much of millennial behav-

ior, beyond new-technology-driven differ-

ences, so far can be attributed largely to

youth, or the realities and perceptions of

youth versus those of adulthood.

Nonetheless, the possibility of

America’s largest generation settling

into homes and having children could

be great news for outdoor participation.

For starters, the rate of participation in

outdoor activities among U.S. female

adults hits a peak around the ages of

26 to 30 years old. For adult males,

participation rates peak around 31 to 35

years old, show the Outdoor Industry

Association’s latest figures. OIA data

also shows that adults with children in

their households participate in out-

door recreation at a higher rate (54

percent) than adults without children

(40 percent), and parents with children

ages six to 12 participated at a slightly

higher rate than parents of other aged

kids. Make no mistake, huge numbers

of potential participants will be added to

those age groups as millennials age.

What’s more, it’s been pretty well

established that most people initially get

introduced to outdoor activities by their

parents, so a growing base of millennial

parents brings with it a growing group

of potential, young participants. And it

shouldn’t be hard to make the case to new

and concerned millennial parents how

nature-based time and recreation posi-

tively impact childhood development.

Studies have shown that children who

spend time in natural or “green” settings

not only are fitter and leaner, but they

develop stronger immune systems along

with reduced cases of myopia (near sight-

edness), play more creatively, test better

in school, are more socially adjusted

and deal with stress better. Research

published in the American Journal of Pub-

lic Health also linked outdoor activities to

reduced ADHD symptoms.

Already within the industry, there is a

movement to position outdoor recreation

as preventive health care. Blue Cross

Blue Shield of Alabama and BlueCross

BlueShield of Tennessee, as examples,

are sponsoring content on RootsRated

in their respective states in the hopes of

encouraging subscribers to get outside

and be active, thereby helping to reduce

many common health ailments com-

pounded by lack of exercise. Similarly,

a recent article in

National Geographic

highlighted Dr. Nooshin Razani, a

pediatric physician at Children’s Hospi-

tal in Oakland, Calif., who has noted a

connection between nature experiences

and health. Nooshin is training pedia-

tricians in an outpatient clinic to write

prescriptions for young patients and their

families to visit nearby parks.

No doubt these are compelling mes-

sages to a group of consumers whose

priorities are shifting from self-expres-

sion and wanderlust to rearing healthy

and happy offspring.

Services such as Uber and Spotify and the emergence of concept such as

the sharing and experiential economies certainly have changed the need or

desire for some young people to buy and own lots of stuff. Even so, as this

feature article illustrates, surveys suggest millennials still hold desires to own

the biggest item of all: a house.

Millennials are also buying more cars as they move into adulthood. The

Echo Boomer generation purchased 4 million cars and trucks last year,

according to the Associated Press, and their share of the new-car market is at

a record 28 percent.

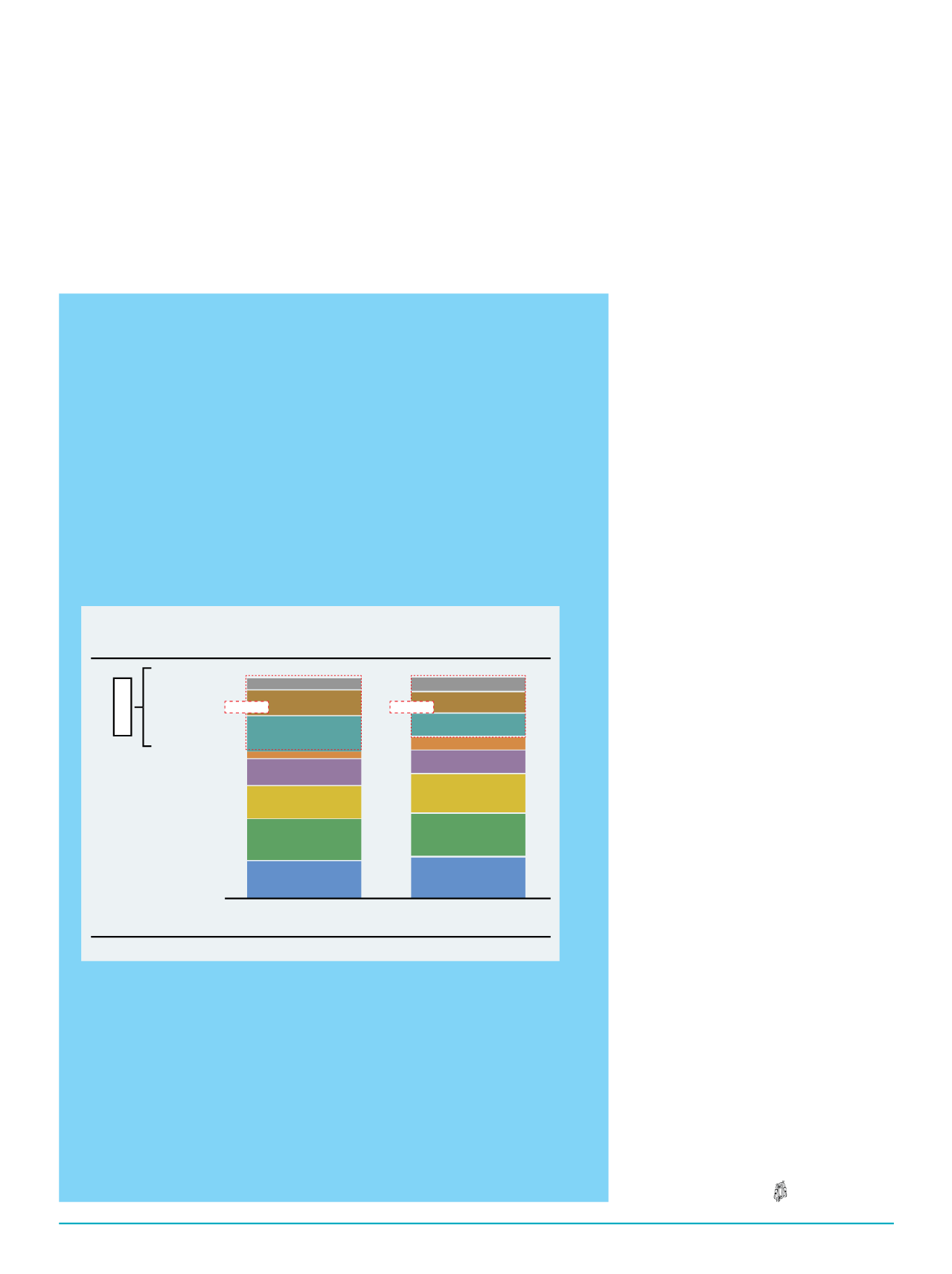

What’s more, a look at spending by category shows only nominal variation

between millennials and other generations, according to data compiled by

JP Morgan. Perhaps the biggest difference is the percentage of dollars going

toward groceries versus restaurants, part of Americans’ ongoing shift from

cooking at home toward dining out. Otherwise, millennials spend noticeably

less on home improvement, but economist expect that to change as more

millennials approach home-buying age and the financial security to take on a

mortgage. And those home improvement dollars are expected to move largely

from the dining and entertainment (experience) categories.

Millennial

Purchasing Myth

Source: Outdoor Industry Association

Average annual spend per customer

Source: OIA

20%

10%

0%

30%

40%

50%

60%

70%

2015 Participation in Outdoor Activities, by Ag

Males

Females

6-10 11-15 16-20 21-25 26-30 31-35 36-40

Age

41-45 46-50 51-55 56-60 61-66 66+

Source: JPMorgan

Spend category distribution by generation

(credit + debit cards, 2015)

Travel

Experiences

34%

28%

Entertainment

Dining

Home improvement

Transportation/fuel

Grocery

Retail

Other

Millennials

$20.0k

Non-Millennials

$24.8k

6%

12%

16%

3%

12%

15%

19%

17%

7%

10%

11%

6%

11%

18%

20%

19%

Inside

Outdoor

|

Winter

2017

20