DATA POINT

Snowshoe Steps

The snowshoe market could use a jolt (maybe in the form of Cres-

cent Moon’s new innovative design), as snowshoe sales are down 4%

in units and 2% in dollars sold, according to SIA’s latest figures. It is

the second straight year of decline in units sold following a healthy

plateau two years ago.

Overnight Ratings

Done in a day be damned.

Despite conventional thought that

backpacking is on life support, figures

from both Outdoor Industry Associa-

tions and the Sports & Fitness Industry

Association show overnight backpack-

ing is doing just fine, thank you very

much. Turns out participation has

grown nicely since 2012.

SFIA Backpacking Participation

Numbers (000)

2012 2015 Five-year Change

7,933 10,100 27.3%

OIA Backpacking Participation

Numbers (000)

2012 % of U.S.

Pop.

2015 % of U.S.

Pop.

8,771 3.1%

10,100 3.4%

8.2

Million

Number of “lapsed”

snowsports participants who

consider themselves skiers

or snowboarders but did

not participate last season,

according to SIA.

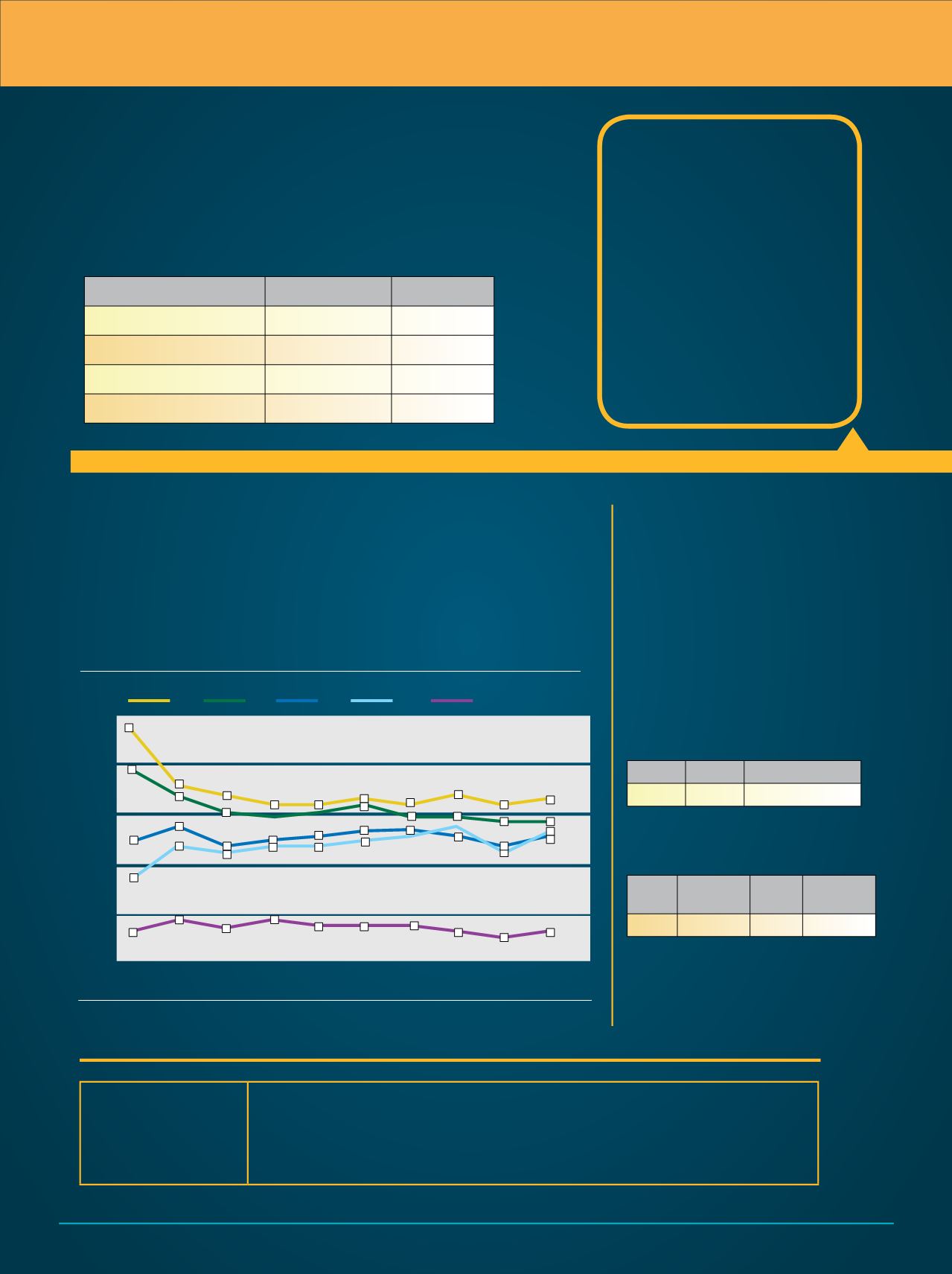

ScreenTeens

The outdoor market’s youth problem illustrated in one line: In

2006 nearly 80% of kids aged 6 to 12 participated in at least one

outdoor activity, show Outdoor Industry Association figures. By

2015, it was 65%. The line isn’t much better for 13 to 17 year olds.

Source: Western States 100-Mile Endurance Run Runner Survey

Usage ofWireless Network in Stores

Source: Retail Systems Research

Outdoor Participation by Age

Source: Outdoor Industry Association

Fenix

2.6%

Black

Diamond

26.5%

Other

5.7%

Black

Diamond

30%

Petzl

55.1%

Petzl

55.1%

40%

50%

60%

70%

2015 Participation in Outdoor Activities, by Age

150

125

68

72

No wireless network

available in store

Wireless available

only for receiving

and o her inventory

control related tasks

Age 6-12 Age 13-17 Age 18-24 Age 25-44

Age 45+

Wireless available

throughout the store

for p rformance

management, POS &

pr duct related tasks

Wireless available

for customers

2016 2015

80%

70%

60%

50%

40%

30%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

8%

31%

19%

25%

51%

25%

23%

19%

Snowshoe Sales, Dollars and Units

Period

Dollars

Units

YTD (Aug’12 - Mar’13)

$15,924,821

122,737

YTD (Aug’13 - Mar’14)

$18,700,467

146,751

YTD (Aug’14 - Mar’15)

$19,732,289

139,953

YTD (Aug’15 - Mar’16)

$19,284,042

133,991

27

Percent of female respondents to a CrowdTwist survey of 1,027 North

American Internet user who said they always buy their preferred brand –

regardless of price, quality, convenience or brand promise. That compares

to 21.3% of male respondents saying the same.

Inside

Outdoor

|

Winter

2017

10