Data

Points

www.insideoutdoor.comR

E

P

M

O

V

E

S

A

N

D

N

E

W

S

www.insideoutdoor.comR

E

P

M

O

V

E

S

A

N

D

N

E

W

S

Data

Points

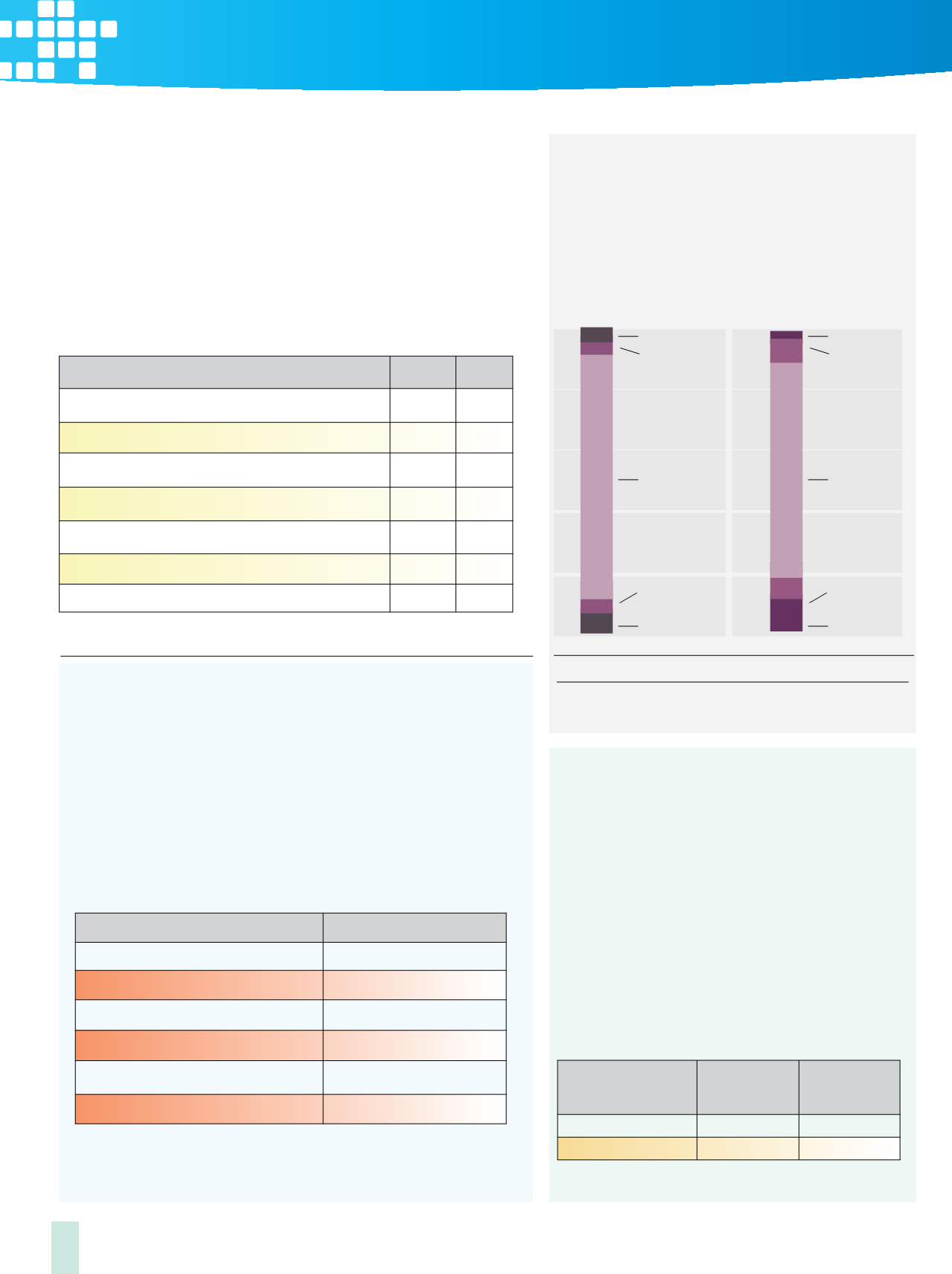

www.insideoutdoor.com www.insideoutdoor.comBigger Tent

Either industry diversity efforts are beginning

to show results, or outdoor participation is simply

catching up with greater U.S. demographic trends.

Regardless, minority groups account for larger per-

centages of outdoor participants than they did five

or so years ago, show OIA figures.

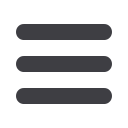

Retail Not Rentals

Consumers apparently are getting more comfortable with the dis-

honest practice of “wardrobing,” or the return of used or non-defective

merchandise. While most areas of return fraud are slowing or are flat

du

ring thepast few years (presumably due mostly to new supply chain

te

chnologies), incidents of wardrobing have increased somewhat sig-

nificantly, retailers tell the National Retail Federation.

WearableTipping Point?

Ipsos MediaCT pollsters believe wearable

technology is approaching a “tipping point,” as

the vast majority of North Americans are at least

somewhat familiar with the category of mobile

devices. Julia Roland, Ipsos vice president, sees

two key characteristics influencing buyers in the

wearable space: consumers are looking for a prod-

uct that seamlessly integrates with smartphones,

laptops and tablets, etc., while seven in 10 pur-

chase intenders indicate that they will only choose

a brand they trust.

Wearable Tech’s Growing Awareness

Own/Very

Familiar

Somewhat

Familiar/Heard

of

Wearable computer

46%

32%

Wearable fitness monitor

41%

39%

Source: Ipsos Poll, December 2014

Email’s Last Stand?

It is likely email eventually goes the way of landline phones, but

for now email remains the favored way for retailers to reach out to

customers. Among the 50% of consumers who are open to receiv-

ing coupons and offers, email is far and away the preferred channel,

shows a survey from MessageSystems and Google Surveys.

Form of Communication Preferred to Share Special

Offers/Deals/Coupons from Brands

Communication

% of Respondents

I don’t want to receive any notifications.

50.08%

25.08%

Text

9.03%

Snail Mail

7.14%

Social Media

5.29%

Push Notification

3.38%

Source: MessageSystems/GoogleSurveys, November 2014

Which examples of return fraud has your company

experienced in the past year?

2012 2014

Returns using counterfeit receipts

45.6% 25.5%

Wardrobing (return of used, non-defective merchandise)

64.9% 72.7%

Return of stolen merchandise

96.5% 92.7%

Return of merchandise purchased on fraudulent or stolen tender

84.2% 81.8%

Employee return fraud or collusion with external sources

80.7% 81.8%

Return using e-receipts

19.3% 18.2%

Returns made by organized retail crime groups

N/A

78.2%

Source: NRF

Source: Adroit Digital

Digital Pedometer/Fit ess Track r Users in U.S.

Broadband Households

Source: Parks Associates

Outdoor Participation by Ethnicity

Source: OIA

93%

2008

2013

90%

Fitbit

Samsung

Nike+Sensor

Nike Fuelband

Garmin

Polar

Jawbone Up

BodyMedia Fit

Adidas MiCoach

Striiv

Basis

Philips DirectLife

Others

0%

20%

Engli

sh18-24

25-34

Spani

shOther 3%

Hispanic

Caucasian

Asian/Pacific

Islander

African

American

Other

Hispanic

CaucasianAsian/Pacific

Islander

African

American

7%

5%

80%

5%

4%

8%

70%7%

11%

Inside

Outdoor

|

Winter

2015

10