activities, and the last few years have brought

about newer, less-rugged forms of camping and

new attitudes about what it means to camp. That

represents a captive audience of new potential

participants. In other words, there are lots of

opportunities for those looking in the right places.

So how big are the opportunities?

According

to the latest figures from The NPD Group, camping

sales through outdoor retail channels jumped 12

percent in 2015, and that’s coming off 7 percent

growth in 2014. Camping category manufacturer

sales increased 4.3 percent in 2015, according

to counts by the Sports and Fitness Industry

Association, which is more than double the increases

seen in SFIA’s overall sporting goods numbers.

Camping manufacturer sales are up 32.7 percent

since 2010. Those are pretty respectable rates for

any market but especially for what’s become a large

and mature one. NPD’s growth rates, after all, are

coming off more than $1 billion in sales.

On the demand side, our National Parks

hosted more overnight tent and backcountry

campers in 2015 than they have since the 1990s.

The increase in total camping visits in 2015

(concessionaire, RV, tent, backcountry) doubled

recent annual growth fluctuations, reaching

more than 9.3 million total camping visits. And

that came after pretty solid growth in 2014. On

public lands managed by the Bureau of Land

Management, camping accounts for an additional

25 million or so visitor days annually, representing

more than a third of BLM total visitor days.

So what’s behind the recent upswing?

For

2015, in particular, warmer winter temperatures

had lots to do with the increases, say NPD

researchers. Quite simply, spring-like low

temperatures in November and December

provided interested parties with more opportunities

to pack up and sleep outside, as well as more time

to purchase or replace gear. And many folks did

just that. Although colder months aren’t typically

associated with camping gear sell-through,

camping sales through outdoor channels jumped

13 percent in the fourth quarter of 2015 over the

same period prior year.

Remaining at a more macro level, the plodding

economic recovery also plays to camping’s

advantage. Real or not, camping has always

been seen as “cheaper than a hotel” for multi-day

outings and out-of-town adventures. But camping’s

use as affordable traveling accommodations has

never been more widespread.

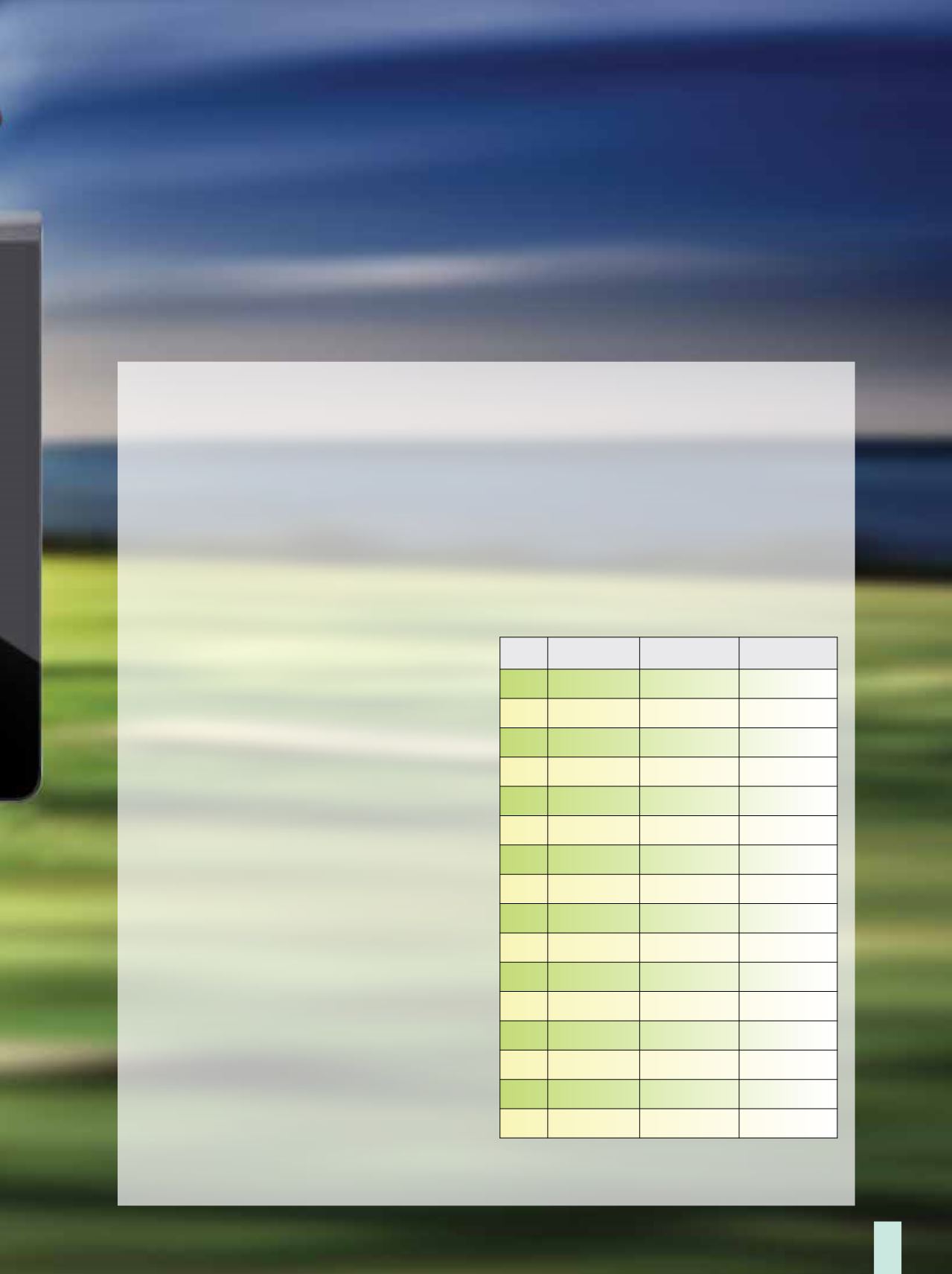

National Park Service Camping Visits by Year

Year

Recreation

Visits

Tent Camping

Visits

Total Camping

Visits

2000 285,891,275 3,395,816

8,832,151

2001 279,873,926 3,326,852

8,773,196

2002 277,299,880 3,357,513

8,740,763

2003 266,230,290 3,303,365

8,546,852

2004 276,908,337 3,128,014

8,141,127

2005 273,488,751 2,974,269

7,998,069

2006 272,623,980 2,882,297

7,829,493

2007 275,581,547 3,003,270

8,114,397

2008 274,852,949 2,956,761

7,992,069

2009 285,579,941 3,184,255

8,504,934

2010 281,303,769 3,277,151

8,575,006

2011 278,939,216 3,229,241

8,309,940

2012 282,765,682 3,203,413

8,397,553

2013 273,630,895 2,993,845

7,914,373

2014 292,800,082 3,246,320

8,451,990

2015 307,247,252 3,680,809

9,382,288

Source: NPS

Inside

Outdoor

|

Spring 2016

31