to identify structured and unstructured

processes that involve system interac-

tions and human interactions, includ-

ing both internal (within the four walls

of the retailer) and external (suppliers

of goods and services), an especially

valuable asset for retail processes that

involve multiple systems, channels and

touch-points.

Once processes are identified, BPM

enables process automation to reduce

errors, maximize profits and ensure

processes are unified, explains Boston

Retail Partners. Additionally, a BPM

solution can be leveraged for active

business activity monitoring, such as

real-time store operations monitoring,

which could provide employees with

real-time visibility to store conditions.

A retailer starts the process by setting

business rules and deviation thresholds

in a closed-loop structure. If a threshold

is met or an anomaly occurs, a manager

can be alerted immediately, enabling

real-time corrective action.

Ultimately, BPM improves processes by

identifying inefficiencies and bottlenecks

within processes so retailers can quickly

make adjustments. And if evolving cus-

tomer demands require a new process to

be created, BPM enables business users to

rapidly construct the new process.

“With BPM, retailers are able to make

more informed decisions, improve per-

formance and ultimately deliver a uni-

fied, continuous customer experience,”

claim Boston Retail Partners executives.

Needless to say, the transition will not

be easy. New technology tends to require

detailed training, and individual roles,

responsibilities and accountabilities will

alter within and across functions.

“Given the way processes and tech-

nologies have been hardwired to serve

consumers by channel, organizational

change requires a methodical approach

that includes clarity, communication and

training,” advises BRP.

And as with most any technology de-

ployment, ROI models will be requested,

as will justification for the retirement of

some legacy systems.

Even so, retail IT departments clearly

are struggling with rapid change and the

need to create omni-channel experiences

for customers.

“Our survey responses show

increased urgency around integrating

selling channels,” notes George Lawrie,

vice president and principal analysts at

Forrester Research.

Indeed, when Forrester asked retail

CIOs to list their top three business

priorities for IT for 2015, integrat-

ing the selling channels to enable an

omni-channel face was second only to

security concerns, listed by 76 percent

of respondents. That was up from the

64 percent with omni-channel concerns

in 2013. Meanwhile, within the same

survey, respondent were ask to name

their top internal considerations around

deploying and managing IT, and 44

percent said “consumers are demand-

ing access to proprietary corporate data

such as product and inventory infor-

mation.” As recently as 2014, only 6

percent expressed this concern, and just

3 percent in 2013.

At the same time, 82 percent of U.S.

consumers recently surveyed by Accen-

ture said they expect a retailer’s prices to

be the same in store and online, a sig-

nificant increase over the 69 percent who

said this the previous year, according to

the consulting firm. But in a benchmark

analysis, Accenture also found that only

one-third of U.S. retailers had consistent

pricing for more than 80 percent of the

items assessed. And while three-quarters

of retailers told NRF they can fulfill inven-

tory across multiple channels, 46 percent

still use spreadsheets to manage their sup-

ply chain planning.

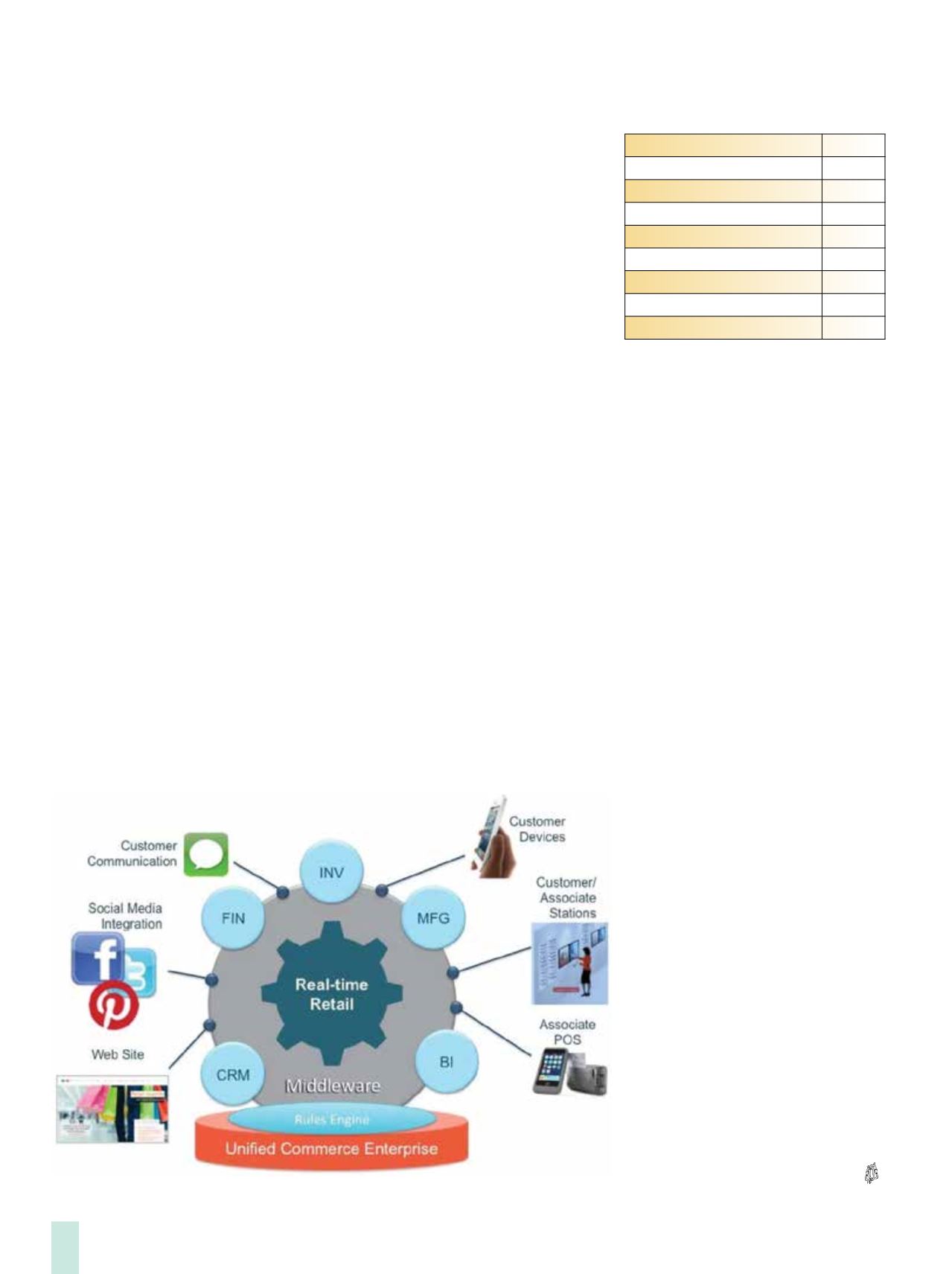

In other words, the transition to

unified commerce is inevitable, but it’s

certainly going to take some time.

“Retailers should expect their plan to

be executed over the course of several

years as they decommission legacy

systems, establish new integrations and

consolidate disparate technologies into

a unified commerce platform – all while

the business continues to serve and de-

light consumers,” concludes the Boston

Retail Partners’ study.

Along the way, IT departments can

reduce the complexity of migrating to a

single channel platform by ensuring that,

moving forward, any infrastructure and

technology investments that are related to

commerce or customers are not hardwired

to existing systems and applications.

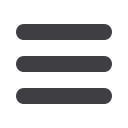

Percent of Retailers that Anticipate

More Than 10% Improvement

from Unified Platform

Operational efficiency

71%

Total customer value

68%

Average order value

67%

Inventory turn

65%

Conversion rate

63%

Promotion redemption

61%

Out-of-stock

60%

Net promoter score

54%

Returns

53%

Source: Boston Retail Partners

Source: Boston Partners Partners

Inside

Outdoor

|

Spring

2015

38