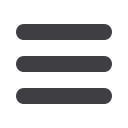

the customer experience. When asked

to prioritize the business imperatives

addressed by unified commerce, retailers

cited as number one the ability to quickly

respond to consumer demand, thereby

enabling organizational agility to effec-

tively execute merchandising, marketing,

promotional and loyalty initiatives. Next

on the list was increasing store associate

productivity by properly arming associ-

ates to enhance customer interaction

and increase conversion. Right behind

these two was a desire to support omni-

channel strategy and execution. This is

achieved by providing the backbone to

manage data and functionality related

to customers, product, price, inventory,

orders and content across channels.

A centralized commerce platform not

only is more conducive to support the

customer experience, Morris points out.

It also offers retailers the opportunity to

leverage a leaner and more flexible store-

level environment through the consoli-

dation of servers, operating systems and

applications at the data center or within

the cloud, rather than at the store.

“Centralization allows for fewer

devices and licenses to deploy and

maintain, and helps application updates

be deployed centrally to improve ef-

ficiency,” he notes.

The Wares

As suggested above, cloud computing

and SaaS, with their inherent speed, agility,

anywhere/anytime access and pay-as-you-

play models, represent the most logical

delivery methods for most next-generation

systems designed to keep up with dynamic

demands. But the “glue” to a unified strat-

egy is a robust middleware layer, or service

oriented architecture (SOA).

As BRP consultants explain, most cus-

tomer interactions and retail transactions

require data from various retail systems to

be gathered, analyzed and disseminated

in real-time. At the same time, it’s silly

to expect retailers to suddenly abandon

each individual legacy application before

Sleep Well.

Play Hard.

Available at Outdoor & Travel Shops Nationwide

W W W

.

C O C O O N U S A

.

C O M

1 . 8 0 0 . 2 5 4 . 7 2 5 8

2015

66%

63%

44%

46%

55%

36%

38%

26%

38%

44%

33%

33%

30%

44%

%

Key Initiatives Addressed by a Unified Commerce Platform

Source: Boston Retail Group, NRF

Percent of Retailers that Anticipat Significant B iness

Benefits Derived from a Unified Commerce Platform

Source: Boston Partners Partners

0%

5%

10%

15%

20%

25%

30%

25%

24%

19%

15%

14%

4%

Quickly

Respond to

Consumer

Demands

M rgin

Brand Value

Revenue

% of respondents

% anticipating

significant benefit

Increase

Associate

Productivity

Support

Omni-channel

Strategy

Rationalize

Portfolio and

Reduce

Complexity

Transform

Store to be

Digital

Efficiently Open

New Store

Formats

(e.g. Pop-up

Stores)

0%

10%

20%

30%

40%

50%

60%

52%

46%

38%

• Inventory Turn

• Out-of-Stock

• Returns

• Operational Efficiency • Total Customer Value

• Net Promoter Score • Average Order Value

• Promotional Redemp

• Conversion Rate

Inside

Outdoor

|

Spring

2015

36