DATA POINT

Girls Rock the Gym

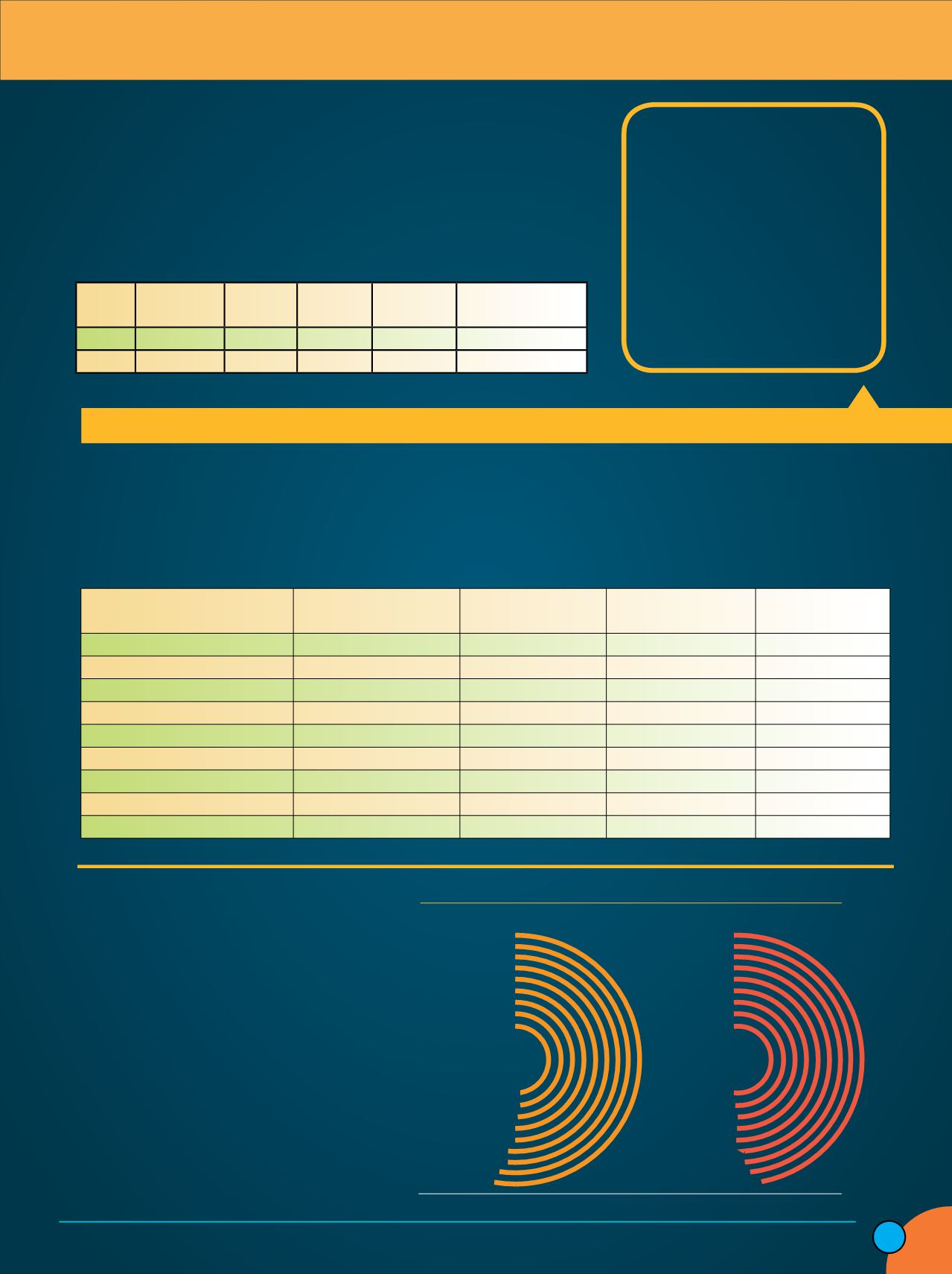

Looking at a few key demographics, outdoor and indoor climbers are fairly

similar. Median age is around 30 for both, and each cohort is just as likely to

have kids at home. One distinction: indoor climbing has certainly attracted

more women to the sport, as 42% of gym climbers are female versus 33% of

outdoor climbers, show OIA figures.

94%

Percentage of store associates

who believe they need more ad-

vanced technology, tools and training

that they currently don’t have access

to, according to Grail Research.

% of respondents

Extent toWhich a Brand’s Social Media

Presence Influences US Social Media

Users’Holiday Purchase Decision, Ages

18 and Up

Source: G/O Digital

A factor,

among other

things

18.9%

Has some influence,

but not overly

important

29.1%

Irrelevant

44.7%

An Important

factor

7.4%

Source: Sprout Social

58.8%

51.3%

42.2% 41.5%

25.1%

21.0%

Interest d in Their

Product/Service

Offered an I centive

Friends Follow/Like

Their Content

Interested in Promotions

Interested in Their Industry

They’re Entertaining

To Communicate with Brand

Percentage of Responses

Likelihood of Buying from a Brand

People Follow on Social Media

Source: Sprout Social

37.8%

NO CHANGE

3.8%

LESS LIKELY

57.5%

MORE LIKELY

2007, 47%

2008, 48%

2009, 49%

2010, 49%

2011, 50%

2012, 50%

2013, 50%

2014, 51%

2015, 52%

shers

Hour Finish

37.9%

31.6%

18.8%

Oka

Altra

Brooks

Hoka

Altra

24.3%

26%

17%

9.4%

20.4%

Source: Anatomy Media

% of respondents

Product Categories that US Teen Internet Users

Prefer to Purchase Digitally vs. In-Store, May 2016

Source: Interactions, eMarketer

U.S. Team Sports Participation

Source: SFIA

Desktop

32%

Mobile

17%

Both

14%

Don’t use

36%

Food

Health & beauty

Shoes

Mobile phones

Jewelry

Clothing

Computers

Games

In-store

Digitally

79%

21%

32%

34%

40%

41%

42%

49%

57%

68%

66%

60%

59%

58%

51%

43%

2007, 53%

2008, 52%

2009, 51%

2010, 51%

2011, 50%

2012, 50%

2013, 50%

2014, 49%

2015, 48%

Core “Participation”

Casual “Participation”

Outdoor vs Indoor Climber Demographics

% Female % Male Median

Age

Have Kid

at Home

Live in City Ctr.

or Outskirts

Indoor

42%

58%

30

68%

55%

Outdoor

33%

76%

31

66%

48%

Source: Outdoor Industry Association

Running for Life

One might think that an important motivation for millennial runners to participate in race and run events is the social

element it provides. A survey by Running USA, however, suggests Echo-Boomer runners enter events largely for the same

reason they run in the first place: fitness. That even goes for obstacle event participants.

Millennials’ Motivations to Participate in Run Events by Runner Type

Motivation 1

S rious Competitive

Runners

Frequent/

Fitness Runners

Recreational

Walkers/Joggers

Obstacle Event

Participants

To improve my physical health

31%

51%

51%

50%

To maintain my physical health

24%

33%

17%

17%

The social aspect of running events

3%

3%

13%

7%

The competitive aspects of events

32%

4%

1%

10%

To run in new/unique environment or venue 3%

4%

5%

7%

To improve my spiritual health

3%

2%

3%

1%

To maintain my spiritual health

2%

2%

1%

2%

To support a charity

0%

1%

6%

3%

Other

1%

1%

2%

3%

Source: Running USA

Team Sports Core Drain

While overall team sports participa-

tion is up slightly, since 2007 team

sports has become more casual and less

“Core” (proportion of athletes playing

very frequently), per the Sports & Fit-

ness Industry Association’s annual re-

port. While the increase in participation

rate is a positive, “losing Core athletes

can create a financial drain on the indus-

try,” says SFIA, as core athletes produce

the most repeated spending.

Fall

2016

|

Inside

Outdoor

9