Data

Points

www.insideoutdoor.comR

E

P

M

O

V

E

S

A

N

D

N

E

W

S

www.insideoutdoor.comR

E

P

M

O

V

E

S

A

N

D

N

E

W

S

Data

Points

www.insideoutdoor.com www.insideoutdoor.comEMV Goal Posts

Despite the apparent complexities of compliance,

U.S. retail CIOs surveyed by Forrester Research are

generally confident about their rollouts of EMV (chip

and PIN) capabilities, with 66% expressing confi-

dence about meeting the October 2015 deadline.

Just about 5 percent said EMV plans have not been

established whatsoever.

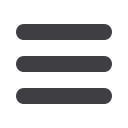

Color Story

Marketers have lots to consider when creating ad creative, but

they best not overlook the importance of one seemingly simple thing:

background color. According to a thorough analysis by Rocket Fuel,

“B

ackground color has a significant impact on ad performance across

ev

ery vertical examined.” Overall, ads with red backgrounds had 31%

higher conversion rates when compared to ads with other background

colors, the highest lift among background colors. Other solid perform-

ers include orange and yellow.

Loyalty in the Cards

The number of loyalty cards is up this year, ac-

cording to surveys by Brand Loyalty, but the num-

ber of active cards has dipped slightly. This seems

to suggest that customers jump on a program to

gain an immediate benefit (or because they don’t

want to say no to an associate) but only find pro-

grams compelling enough to continue using them

about half the time.

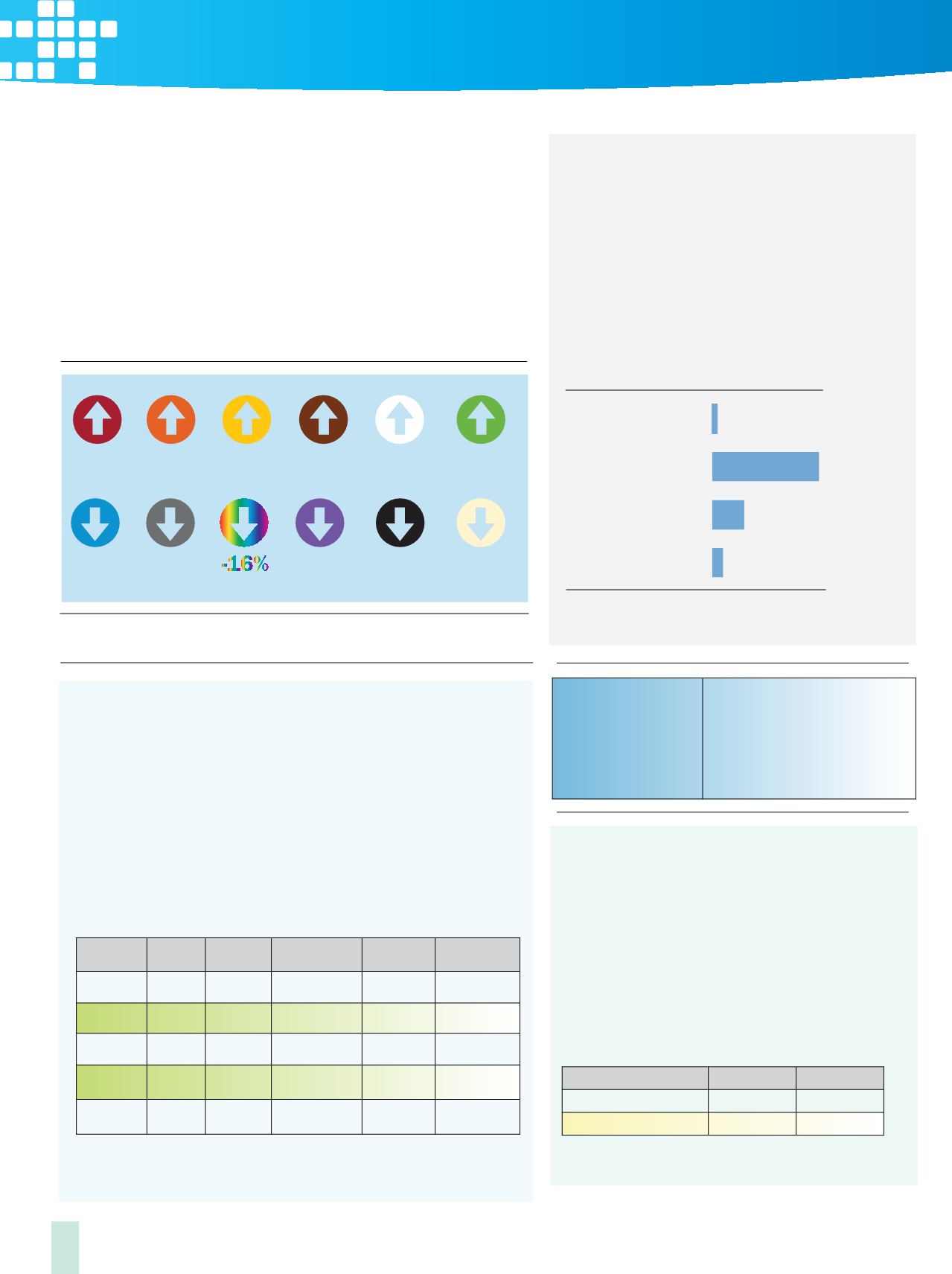

Set Up Camp

Despite lackluster growth in participation numbers and a general

sentiment that camping is not cool among younger demographics,

sales of camping gear have been rather robust the past few summers.

In the months from May to September, sales of camping gear have

grown year-over-year since 2012, often in the double digits, accord-

ing to figures from OIA’s VantagePoint. Among those months, the

greatest growth since 2012 seems to be happening in August, which

saw double-digit jumps in both 2013 (23.1%) and 2014 (10.6%).

Top IT Priorities for Retailers in 2015

Source: Bost n Retail Partners

Regarding the rollout of EMV (chip and

PIN) capabilities, what are your plans

to meet the October 2015 mandate

for liability shift?

Source: Forrester Research

Retailers Top Challenges for 2015

Source: Rocket F el

31%

28%

24% 14%14%

-1%

-8%

-16%

-22%

We’re already ready

We’ve started this project

and will be in pilot or partial

rollout by October 2015

We haven’t yet started this

project but will be ready by

October 2015

We will deploy in our

next POS refresh cycle

Payment security

Improving customer service

Implementing single commerce solution

Empowering associates

Securing customer data

Unified commerce platform

Real-time retail

Customer-facing

technology in the store

Mobile point of sale

3%

66%

20%

63%

44%

26%

44%

34%

24%

6%

48

Percentage of retailers that said employee

access to Wi-Fi has had a positive impact

on customer loyalty and sales, with

an average increase of sales at 3.4%,

according to IHL Group surveys.

Top IT Priorities for Retailers in 2015

Regarding the rollout of EMV (chip and

PIN) capabilities, what are your plans

to meet the October 2015 mandate

for liability shift?

Source: Forrester Research

Background Color Performance

Phases of Journey Toward Unified Commerce Pl

Source: Rocket Fuel

Source: Bos on R

etail Partners, NRF

recreation, or leisure activities

Running errands or shopping

Traveling to and from

work or school

Traveling to and from public

transportation

Escorting children to and

from school or daycare

Other type of transportation

bicycling

70%

63%

46%

32%

19%

24%

Source: Breakaway Research Group; PeopleForBikes

0 10 20 30 40 50 60 70 80

31%

28%

24%

14%

14%

13%

-1%

-8%

-16%

-22%

-23%

We’re already ready

We’ve started this project

and will be in pilot or partial

rollout by October 2015

We haven’t yet started this

project but will be ready by

October 2015

We will deploy in our

next POS refresh cycle

Payment security

Unified commerce platform

Real-time retail

Customer-facing

technology in the store

3%

66%

20%

63%

44%

44%

34%

6%

Exploration

C nsideration

Strategy

Execut

13%

23%

36%

13%

Monitoring Single

Platform Trend

and Gathering

Informati n for

Education

Actively

Discussing

Viability of a

Single Platform

Aproach, but no

Formal Plan or

Budget in Place

Creating a

Formal Plan,

Developing

Business Case,

and Seeking

Budget

Imple

a Strat

Busine

Techni

Manag

Key Initiatives Addressed by a Unified Commerc

Source: Boston Retail Group, NRF

Percent of Re

Benefits Deri

0%

5%

10%

15%

20%

25%

30%

25%

24%

19%

Quickly

Respond to

Consumer

Demands

% of respondents

% anticipating

gnificant benefit

Increase

Associate

Productivity

Support

O ni-channel

Strategy

R

P

R

30%

40%

50%

60%

•

•

•

•

Camping Gear Sales and Growth by Month ($Millions)

2012 2013 YoY % Ch.

2014

YoY %Ch.

May

$127.9 $129.9 1.6%

$143.7

+10.97%

June

$166.2 $178.3 7.3%

$194.7

+9.2%

July

$122.5 $138.4 12.9%

$152.6

+10.3%

August

$111.9 $137.8 23.1%

$152.6

+10.6%

September

$109.1 $112.4 3.0%

$122.0

+8.6%

Source: OIA VantagePoint

Number of Loyalty Cards Held and Used

2014

2015

Cards in wallet

10.9

13.3

Cards considered active

7.8

6.7

Source: Brand Loyalty

Inside

Outdoor

|

Spring

2015

10