particular purchase that day you were

supposed to use it on a future trip to the

store. Understandably, it was a point of

contention with some customers.

Several stores had “use it or lose

it” caveats similar to flexible benefit

programs. One retailer I spoke with

discovered that only 50 percent of

those entitled were actually using the

benefit. Other point programs have

expirations dates ranging from 90

days to a year to never.

Another store merchandise manager

told me that their system required a lot

of maintenance and backend confu-

sion and went on to say, “Personally, it

doesn’t drive me to shop.” When asked

if she would have a similar program if

she owned the company, the answer

was a resounding “no.”

Ideas to consider instead

of tracking points

Some stores feel that having fre-

quent sales and promotions where

good customers can benefit from extra

savings provides sufficient value. Oth-

ers find that using coupons in various

denominations with tight usage win-

dows are better motivators. Additional

options to consider, in lieu of buyer

programs, might include gift-with-

purchase or purchase-with-purchase

ideas, a marketing concept popular-

ized and still very much in use today

by cosmetic companies. I have had

stores tell me that they experience

very strong response and much better

than average return to customer ap-

preciation letters. These are sent out

annually with varying dollar amounts

based on how much the customer has

spent the previous year. (Customer

appreciation letters are very effective

if set up correctly, and implementation

isn’t difficult or time consuming, but

we’ll leave that for a future column.)

In the end, a retailer should regu-

larly review the true value of any fre-

quent buyer program by looking at

all facets. Are customers really more

loyal to the store because of them?

Are frequent buyer programs becom-

ing generational? Meaning do they

appeal to certain age demographics

more than others, say customers over

age 40? Should credit be given on all

purchases or just full price?

If every store has a program, does

it really make a difference? Is our pro-

gram simple to manage and easy for

the customer to understand? An argu-

ment could be made that customers

should be shopping your stores be-

cause they enjoy the experience, your

people, and the selection of merchan-

dise and not simply because they rack

up frequent buyer points that at least in

some cases go unused.

When you embark on a new buyer pro-

gram, remember it is always easier to add

more later than to take things away, if you

come to the realization that your program

is becoming cost prohibitive. Strongly

consider awarding points on full-price pur-

chases only to help minimize costs. When

associates fill out a new customer profile

for a buyer program, they must have at

a minimum name and email address.

Additionally, mailing address and phone

number would also be helpful. With that

information, you will at least have a tool

to reach out to them in the future.

If you have a frequent buyer pro-

gram, review it today and be sure to

find out how much you are giving away

in reward dollars. If you are considering

one of these programs, you must do

your homework or run the risk of hav-

ing to answer the question Connie

Francis posed back in 1958 when she

crooned … “Who’s sorry now?”

Ritchie Sayner is the author or “Re-

tail Revelation –Strategies for Improving

Sales, Margins, and Turnover,” avail-

able from Amazon. He can be reached

at

RSayner@rmsa.com.BACK

OFFICE

Source: Physical Activity Council

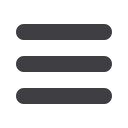

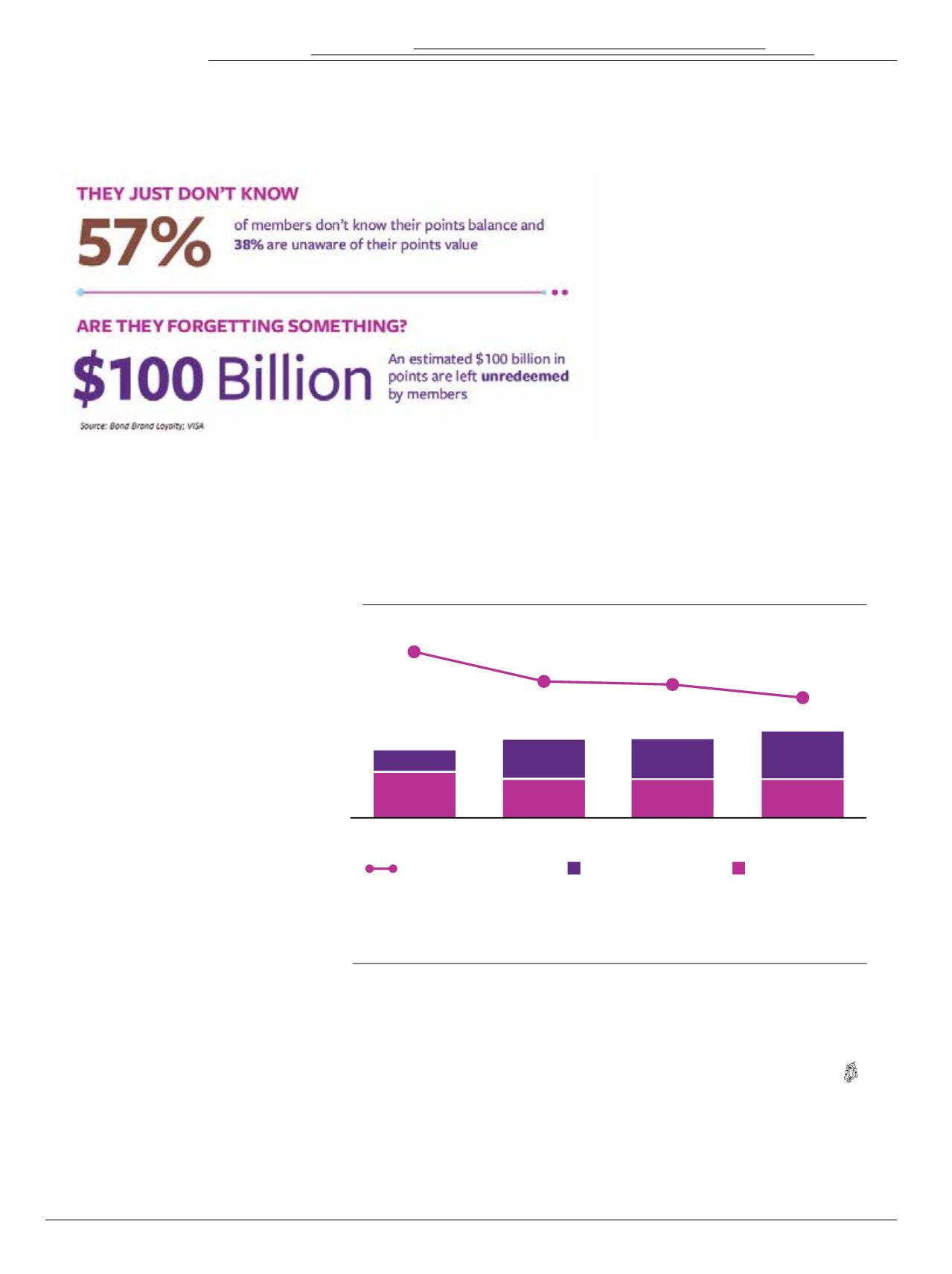

Loyalty Memberships Up, Engagement Flat

Source: Bond Brand Loyalty; VISA

0%

10%

20%

30%

40%

50%

60%

48.1%

42.9%

32.9%

31.8%

25.1%

24.9%

19.3%

20.1%

18.8%

18.6%

18.5%

17.3%

16.3%

16.6%

14.8%

13.7%

12.6%

11.6%

12.4%

11.7%

11.8%

11.7%

7.8%

7.7%

17.1%

17.3%

Having someone to take part with

Having a friend take me along

Being in better health

More vacation time

Fewer work commitments

Having an introductory

lesson or outing

Fewer family commitments

2014

2015

Having a friend instruct me

Having a tax break on equipment,

membership, fees and insturction

Availability of better

multi-use trails and sidewalks

to my heighborhood

New equipment

Having the activity sponsored

by my employer

Something else

72%

47%

14.3%

6.7%

10.9

7.8

2014

2015

2016

2017

% Active Memberships

Total Memberships

Active Memberships

Since 2014 study, the average number of program memberships per American consumer

has increased steadily from under 11 to more than 14. Meanwhile, the number of programs

in which members are active is virtually unchanged at just under 6.7 (47%).

!

!

Inside

Outdoor

|

SUMMER

2017

24