I

f the participants of the annual

Western States 100-Mile Endurance

Run are any indication of the brand

preferences of the larger trail running

enthusiast market, there appears to

be some shake-up afoot in the trail

shoe category. Along with a few upstarts

extending leads, a few legacy brands are

showing signs of struggle.

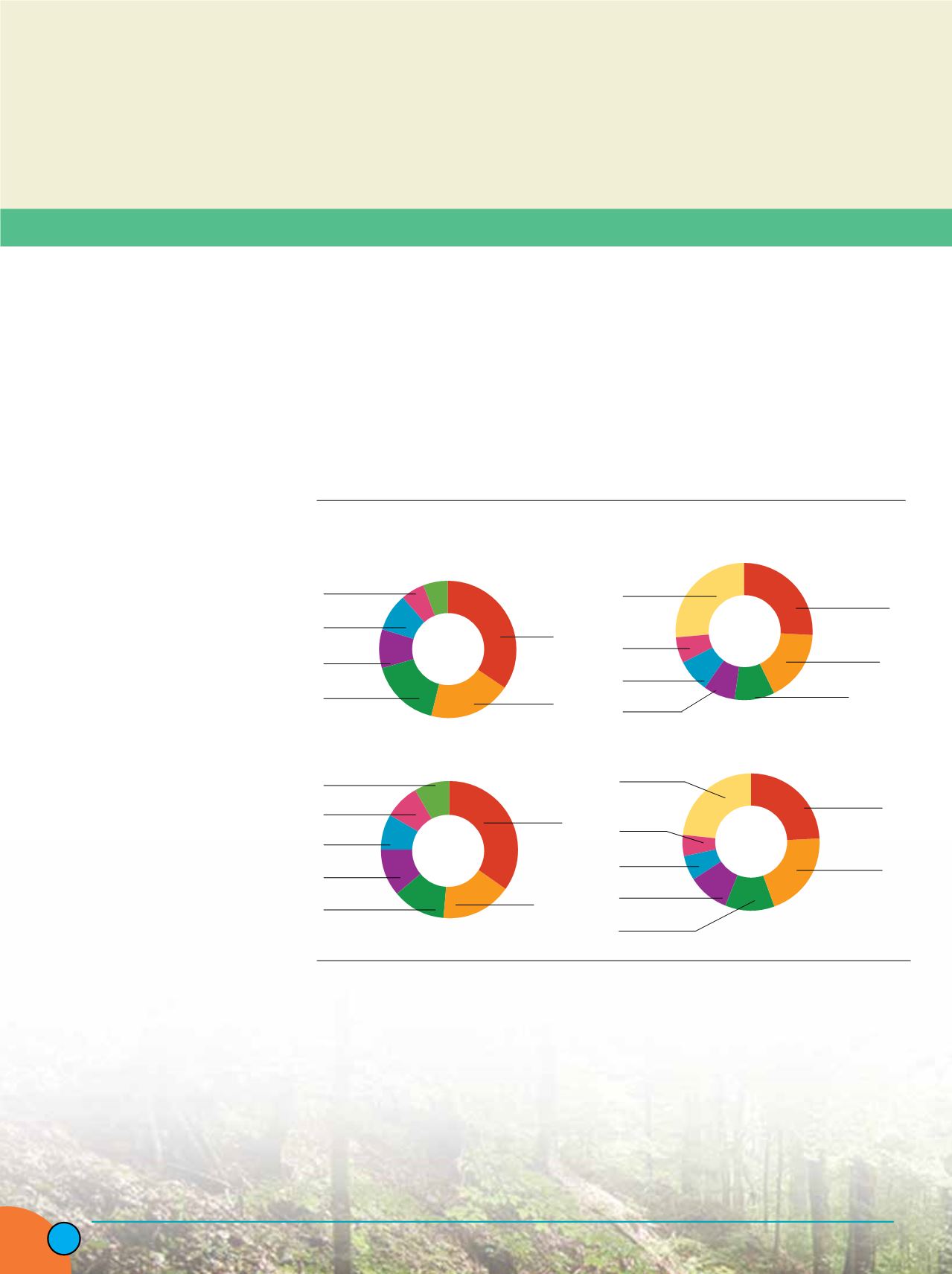

Hoka One One, once again, was the

best represented brand among these elite

runners, found on the feet of 26 per-

cent of all finishers. Although Hoka did

slip a bit from its seeming dominance

in 2015, when it was found on 34.5

percent of finishers.

Altra, meanwhile, was arguably

the biggest winner in 2016, becom-

ing the second most popular shoe

among contestants and found on the

feet of 17 percent of all finishers and

20.4 percent of sub-24-hour finish-

ers. That’s up from 5.8 percent of

all finishers in 2014, when Altra was

the seventh most popular shoe at

WSER. Part of Altra’s gain apparent-

ly came at a loss for Brooks, which

fell to third on the list after strong

second place showings the previ-

ous two years. Brooks’ market share

percentage among all finishers

was essentially cut in half, while it

remained less of a contender among

the sub-24-hour group.

Along with Brooks, a few other

veteran brands have seen their West-

ern States stock slip. In 2014, Pearl

Izumi was the second-most popular

brand, at 12.8 percent, among elite

sub-24-hour finishers and the fourth-

most popular among all finishers.

During the past two years, Pearl

Izumi has fallen to sixth place among

all finishers and was lumped into

the “others” category among sub-

24 finishers in 2016. It should be noted

that in August of this year, Pearl Izumi

announced plans to shutter its “Run busi-

ness” in an attempt to re-focus resources

on the cycling and triathlon markets.

Perhaps Pearl Izumi’s dip in popularity

with trail runners is either a reason for or

a result of (or likely both) this decision.

Even more dramatic of a decline is

seen with Montrail, which all but disap-

peared from the WSER Runner Survey

in 2016. After solid showings the previ-

ous two years among both all finishers

and sub-24 finishers (the brand was

among the top three most popular for

both cohorts in 2014), Montrail also was

lumped into the “others” category at the

most recent Western States, falling be-

low a 5 or 6 percent market share. Could

it be that Columbia Sportswear’s plans

to sub-brand Montrail under the Colum-

bia brand does not sit well with harder

core trail running enthusiasts? Perhaps

Columbia is willing to forego that appeal

for a more mainstream audience?

Salomon, for its part, as well as New

Balance, have held their places rather

well, if only seeing slight declines due to

the rise of Altra and Hoka. Nike, mean-

while, has a rather unique story with

WSER trail running enthusiasts. In both

2014 and 2015, Nike is the only brand

that appears in the top five among sub-

24-hour finishers but does not appear

at all on the list of top brands among

all finishers. Call it the Nike inferiority

complex, but things changed in 2016, as

racers possibly noticed the Nikes on elite

finishers during the previous few years.

Indeed, Nike made a sudden and strong

appearance among all finishers surveyed

in 2016, coming in fifth place and found

on 7.6 percent of their feet (the same

percentage as Salomon).

If nothing else, the results of the 2016

Western States runner survey suggests

the trail runner category is anything but

staid or impenetrable by emerging brands,

and it’s not consolidating the way maturing

markets tend to do. In 2015, for instance,

the top three brands were found on 70.6

percent of all finishers. Those same three

brands showed up on only 52.5 percent of

finishers at the 2016 event.

At the same time, more than a quar-

ter of finishers were sporting brands

(the “other” category) with less than 6

percent market share.

Elite Feet

Shoe brand SPOTTING attheWestern States 100-Mile Run

By Martin Vilaboy

Media Users Are Most Likely to Tu

Holiday Shopping Ideas/Inspiratio

Source: GO/Digital

mance by Device

ommerce

by Day

Shoe Brand - All Finishers

Shoe Brand - All Finishers

Shoe Brand - Sub 24 Hour Finish

Shoe Brand - Sub 24 Hour Finish

5.5%

63.8%

5.2%

6.3%

30.5%

28.2%

8.6

10.3

$136.42

$134.06

12.5%

42.7%

Tablet

Desktop

21.5

17.7

Display ads

online

CYBER MONDAY

+12.5%

LAST MIN. RUSH

“CYBER WEEK”

NOV 24-30

BLACK FRIDAY

+17.4%

RKEY DAY

+10.7%

% of respondents

4.1%

4.3%

0.7%

0.5%

0.2%

18.8%

2015

2016

Snapchat

P riscope

Other

WSER Shoe Brand Survey

Source: WSER Runner Survey

Pearl

Izumi

Salomon

Montrail

Altra

Others

Oka

Altra

Brooks

Pearl Izumi

Nike

Salomon

New

Balance

Brooks

Nike

Salomon

Montrail

Others

Brooks

Hoka

Altra

New Balance

Salomon

Brooks

Hoka

Altra

Hoka

Nike

5.7%

8.8%

9.3%

16.5%

8.3%

23.3%

24.3%

26%

17%

9.4%

20.4%

26.4%

6.1%

7.6%

7.6%

4.9%

5.8%

9.7%

11.7%

8.3%

8.3%

11.1%

12.5%

34.5%

19.6%

34.7%

16.7%

11

11

67

72

47

26 21

21

17

73

24

25

21

12

10

6

5

25

12

9

8

6

6

6

38

32

18

17

Inside

Outdoor

|

Fall

2016

12