Inside

Outdoor

|

Fall

2015

44

kenneth j hamilton / Rumney, nh

nanospikes is a trademark of kahtoola inc.

Not that a slower opening weekend

ruined retailers’ holidays. When all

was said and done, sales were rather

healthy, with growth slightly outpacing

long-term trends. Rather, consumers

say they are starting earlier, to avoid

the rush, as well as shopping later into

the season, to take advantage of anti

cipated late-season discounting. In other

words, there may need to be some

re-assessment as to what counts

as “holiday sales,” as Christmas

creeps further back toward Hal-

loween and onto New Year’s.

As for 2015 expectations, the

prognosticators’ sales growth predic-

tions range anywhere from 2.4 per-

cent (ShopperTrak) to 3.3 percent

(International Council of Shopping

Centers) to just more than 5 percent

(Deloitte), pretty much in range with

the predictions and results we have

seen since 2008. Also like most

other years, these analysts point to

variables such as gas prices, stock

market indices, wage stagnation

and even a “government shutdown”

(yes, again). One such firm, however,

relies less on these broad economic

indicators, insisting that the best

gauge of what consumers will spend

during the holidays is what they’ve

spent so far that year.

Looking at historical retail sales data

from 1992 to present from the Depart-

ment of Commerce, AlixPartners says

it can reasonably predict holiday sales

based on current-year sales through

the end of back-to-school. Excluding

2008 (what AlixPartners calls a “Black

Swan event”), sales through the back-

to-school period have consistently ac-

counted for between 65.5 percent and

66.8 percent of annual sales. In the last

five years, that range has tightened,

averaging between 66.2 percent and

66.4 percent of annual sales – result-

ing in a miniscule standard deviation.

By this measure, AlixPartners predicts

holiday sales will increase 2.8 percent

to 3.4 percent in 2015.

Breaking out sporting goods sales

specifically, sales through August 2015

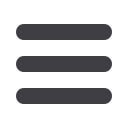

What are the top three ways you became aware of a shopping Web site this holiday?

Source: Prosper Insights & Analytics;

Shop.orgPearl

Izumi

Salomon

Montrail

Altra

32.4%

30.0%

15.9%

10.6%

10.5%

10.4%

8.3%

7.4%

6.7%

6.6%

6.2%

6.1%

5.5%

4.9%

Shoe Brand - All Finishers

Shoe Brand - Sub 24 Hour Finish

5.7%

8.8%

Hoka

Brooks

34.5%

19.6%

Hoka

35.7%

9.3%

16.5%

New

Balance

8.3%

Source: AixPar ners; US Census Bureau, Seasonally Adjusted Retail Sales (Excludes Motor Vehicles,

Gas, Food Services & Drinking Places)

0

500,000

Email from the retailer

Shopped from the Web site before

Used search engine results

(e.g. Google, Yahoo!, MSN, AOL, other)

Online ad

Recommendation from friend,

family member or colleague

Deal of the day sites (e.g. Group. LivingSocial)

Shopped in the physical (offline) store before

Catalogs

Print adverting

TV advertising

Go to a bookmark that I have set

Social netwokring sites

(e.g. Facebook, Twitter, Pinterest, etc.)

Email from another site/not retailer

Typing store’s URL or

web address into my Web browser

Through BTS

Sept - Dec Sales

Holiday Sales

1,000,000

1,500,000

2,000,000

2,500,000

3.2%

-3.9%

0.1%

2.9% 3.4%

4.0%

2.0%

0.0%

-2.0%

-4.0%

-6.0%

Sales ($M)

YOY Holiday Sales %

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2014

2013

2012

0%

20%

40%

60%

80%

67

6

6

38

32

18

17

11 11

Brooks

8.3%